Long term care insurance applications must contain plain and unambiguous – Long-term care insurance applications must contain plain and unambiguous language. Clear communication is paramount in this crucial area of financial planning. Precise wording avoids misunderstandings and ensures policyholders fully grasp the implications of their decisions. This approach fosters trust and transparency in the insurance process.

This discussion delves into the critical elements of crafting clear and concise applications, from defining coverage scopes to outlining exclusions and limitations. A focus on plain language benefits both the insurer and the policyholder, paving the way for a smoother, more comprehensible application experience.

Clarity and Precision in Language

Clear and straightforward language is crucial in long-term care insurance applications. Policyholders need to easily understand their coverage options, responsibilities, and potential costs. Ambiguity can lead to misunderstandings and dissatisfaction, ultimately impacting the success of the insurance product.Using precise language ensures that policyholders are aware of the specific terms and conditions associated with their chosen plan. This clarity fosters trust and confidence in the insurance provider.

Avoidance of complex jargon simplifies the process and makes it accessible to a broader audience.

Examples of Clear and Unambiguous Language

This section provides examples of how to express key concepts in a clear and unambiguous manner. The goal is to ensure that policyholders grasp the intended meaning without needing clarification.

- Instead of: “Beneficiary’s rights are contingent upon the extent of the insured’s incapacity, as per the established guidelines.” Use: “If you become unable to care for yourself, your designated beneficiary will be entitled to benefits based on the specific criteria Artikeld in the policy.”

- Instead of: “Pre-existing conditions may influence eligibility and benefit amounts.” Use: “Conditions you have before purchasing this policy may affect the coverage you receive and the amount of benefits you are entitled to.”

- Instead of: “Policyholder must adhere to all stipulated stipulations for coverage continuation.” Use: “To maintain your coverage, you must follow the rules and regulations Artikeld in the policy.”

Importance of Avoiding Jargon and Technical Terms

Using technical terms can make the application confusing for policyholders. Avoid technical terms and use everyday language instead.

- Instead of using technical terms like “rescission” or “actuarial tables”, use simpler language like “cancellation” or “estimated costs.” This will make the policy understandable to a broader audience.

Impact of Simple Language on Policyholder Understanding

Clear and concise language significantly enhances policyholder comprehension. This improved understanding translates to greater trust and satisfaction. A simplified approach makes the application process less daunting and more approachable.

- Using simple language reduces the potential for misinterpretation, ensuring policyholders fully grasp their rights and responsibilities.

- Straightforward language fosters a more positive experience, building trust between the policyholder and the insurance provider.

- Policyholders are more likely to review the entire policy with care and confidence when the language is clear and straightforward.

Comparing Clear and Confusing Language

The following table illustrates the difference between clear and confusing language in application examples.

| Confusing Language | Clear Language |

|---|---|

| “Extent of impairment must be demonstrably consistent with policy guidelines.” | “Your disability must meet the specific requirements Artikeld in the policy.” |

| “Policy stipulations mandate timely submission of claim forms.” | “You must submit your claim forms promptly as specified in the policy.” |

| “Eligibility criteria are subject to underwriting procedures.” | “Your application will be reviewed to determine if you qualify for coverage.” |

Structuring Application Sections for Clarity

Clear structure is vital for an easy-to-understand application. Organize sections logically and use headings and subheadings to guide the reader.

Long-term care insurance applications need crystal-clear language. It’s crucial for avoiding misunderstandings later, especially when you’re looking for a place like a 1 bedroom apartment for rent lynn ma. Finding the right place is a huge step, and having a straightforward application process is just as vital. Clear applications prevent costly problems down the line. So, when you’re considering long-term care insurance, make sure the application is as straightforward and easy to understand as possible.

1 bedroom apartment for rent lynn ma should have a similar focus on clarity.

- Use clear headings and subheadings to indicate the purpose of each section.

- Present information in a logical order, making it easy to navigate and understand.

- Group related information together to avoid confusion.

Defining Coverage Scope

Getting your long-term care insurance right involves clearly understanding what’s covered. A precise definition of coverage is crucial to avoid surprises and ensure your needs are met during a challenging time. This clarity helps you make informed decisions and avoid potential financial burdens.

Examples of Clear Coverage Definitions

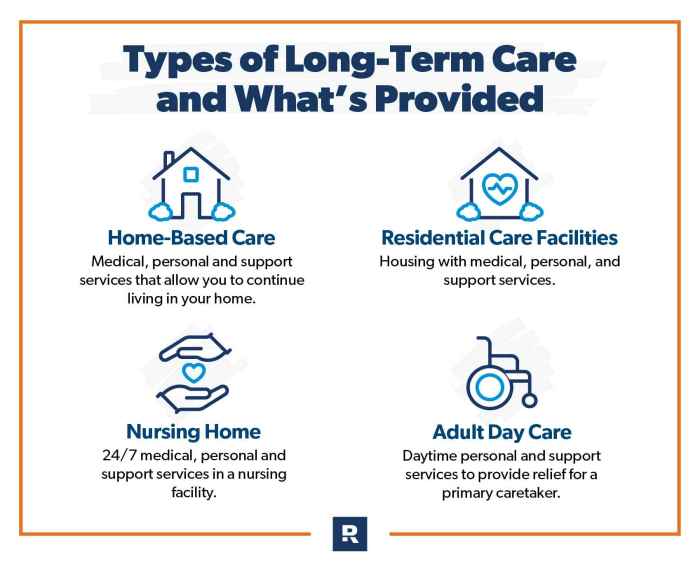

Defining coverage in plain language is key. Instead of complex jargon, use everyday terms. For example, instead of “custodial care,” you might use “help with daily tasks like bathing and dressing.” A policy should specify thetypes* of care included, such as skilled nursing, home health aides, or assisted living facilities. Illustrative examples are vital. A policy might state, “Coverage applies to medically necessary care for conditions like Alzheimer’s disease, stroke, or Parkinson’s.”

Defining “Qualifying Event”

A “qualifying event” is the trigger for coverage activation. A clear definition ensures everyone understands when the insurance kicks in. This could include a specific diagnosis or a documented level of functional decline. For example, a policy could state, “Coverage begins when a physician certifies the insured needs assistance with at least two activities of daily living (ADLs), such as eating or dressing.”

Defining “Care Needs”

The policy should precisely define the level of care required for coverage. This might involve specific criteria, like the number of hours of care needed each day or the complexity of the tasks. For instance, a policy could state, “Coverage applies when the insured requires at least 4 hours of assistance per day with personal care activities.” The policy must be very clear about the expected level of care.

Defining “Pre-Existing Conditions”

Policies should clearly Artikel how pre-existing conditions are handled. A well-defined process avoids confusion and potential exclusions. A policy might state, “Pre-existing conditions diagnosed within the two years prior to application may be excluded, but will be evaluated on a case-by-case basis with medical evidence.”

Specific and Concrete Examples in Policy Language

Using specific examples within the policy language strengthens understanding. For instance, instead of “substantial functional impairment,” the policy could list specific examples like “inability to bathe independently” or “need for assistance with dressing.” This makes the policy more accessible and reduces ambiguity.

Potential Legal and Financial Implications of Vague Coverage

Vague coverage descriptions can lead to disputes and financial losses. If a policy is unclear, a claimant may not receive the expected benefits, or they might face legal challenges in proving their eligibility. This could lead to considerable financial stress during a vulnerable period.

Table of Key Coverage Aspects and Definitions

| Coverage Aspect | Clear Definition |

|---|---|

| Qualifying Event | A specific diagnosis or documented functional decline, such as needing assistance with two or more activities of daily living (ADLs). |

| Care Needs | The specific level of care required for coverage, defined by hours of assistance needed daily and the complexity of tasks. |

| Pre-existing Conditions | Conditions diagnosed within a specific timeframe (e.g., two years) prior to application may be excluded, but will be reviewed based on medical evidence. |

| Covered Services | Specific types of care like skilled nursing, home health aides, or assisted living, explicitly listed in the policy. |

Understanding Exclusions and Limitations

Knowing what’s NOT covered in your long-term care insurance policy is just as important as what is. Exclusions and limitations protect the insurance company from excessive claims and help define the precise circumstances under which coverage applies. Understanding these specifics is crucial for making informed decisions.

Exclusionary Clauses in Long-Term Care Policies

Long-term care policies often have exclusions to prevent coverage for certain conditions or situations. These clauses protect the insurer from potentially large payouts for pre-existing conditions or situations not directly related to the need for long-term care. Careful review of these clauses is essential.

| Type of Exclusion | Description | Example |

|---|---|---|

| Pre-existing Conditions | Conditions diagnosed or treated before the policy effective date. | A person diagnosed with arthritis prior to purchasing a policy may not be covered for long-term care related to the arthritis if it is considered a pre-existing condition. |

| Conditions Excluded by Policy | Conditions specifically excluded in the policy wording. | Some policies may exclude coverage for conditions like substance abuse or mental health disorders if they are not directly causing a need for long-term care. |

| Care Provided at Home | Conditions for care provided at home, even if the need for care is covered. | If a policy excludes coverage for home health care, even if the individual requires ongoing care, the policy will not cover this. |

| Specific Types of Care | Care that is not covered by the policy, like certain therapies. | Some policies may not cover certain therapies or procedures, even if long-term care is required. |

| Certain Medical Procedures | Specific medical procedures or treatments that may be excluded from coverage. | Cosmetic surgery or procedures not directly related to long-term care needs may be excluded. |

Presenting Exclusions and Limitations Clearly

Clear communication of exclusions is vital. Avoid jargon and use plain language. Using specific examples helps illustrate the meaning and application of exclusionary clauses.

- Use simple language. Avoid complex legal terms. Explain exclusions in a way that is easy to understand.

- Bullet points and numbered lists. These formats make it easy to quickly grasp the specifics of exclusions and limitations.

- Specific examples. Instead of saying “certain conditions,” give concrete examples, such as “conditions related to substance abuse.” This makes the exclusions more relatable.

- Avoid ambiguity. Be precise in defining what is not covered. Use clear wording to prevent misunderstandings.

Impact of Specific Examples

Illustrative examples make exclusions more understandable. Instead of abstract statements, concrete examples make the exclusionary clauses more meaningful. This helps policyholders grasp the practical application of these clauses.

- Relatability. Concrete examples make the exclusions more relatable to potential policyholders. This enhances their understanding and decision-making process.

- Reduced Confusion. Using examples clarifies the boundaries of coverage, minimizing potential confusion and misinterpretations.

- Enhanced Decision-Making. Clear examples allow individuals to make informed choices based on their specific needs and circumstances.

Application Process and Procedures: Long Term Care Insurance Applications Must Contain Plain And Unambiguous

The application process for long-term care insurance should be straightforward and easy to understand. Clear instructions and a well-structured application form are crucial for a positive experience. This section Artikels how to navigate the application process effectively.The application forms should be designed with user-friendliness in mind. This includes using simple language, clear headings, and logically organized sections.

This ensures that applicants can easily locate the information they need and complete the necessary steps without confusion.

Long-term care insurance applications need crystal-clear language. It’s crucial for understanding the policy’s specifics, and a good place to check out different options is by looking at reviews of secure insurance solutions like premier secure insurance solutions reviews. Ultimately, those applications must be straightforward to avoid confusion and ensure you’re making an informed decision.

Application Form Structure

The application form should be structured to gather all the required information in a logical sequence. Each section should have a clear label and instructions. For example, personal information, medical history, and financial details should be presented in distinct sections with accompanying prompts to guide the applicant. Fields should be designed with specific data types (e.g., dates, numbers, text).

This ensures accurate data entry. Avoid overly complex layouts and unnecessary questions.

Precise and Unambiguous Form Completion

Using precise and unambiguous language in the application is essential. Vague or open-ended questions can lead to misunderstandings and errors. Instead of asking “Are you healthy?”, a specific question like “Have you been diagnosed with any medical conditions in the past 5 years?” provides clearer direction. Providing examples or templates for completing certain fields can be helpful for applicants.

For instance, if the form asks for a list of medications, providing a table to list the name, dosage, and frequency of each medication helps.

Methods for Presenting Application Information

Different methods for presenting application information can be used. A standard paper-based form is still a common method. However, online applications allow for easier data entry, immediate processing, and potentially reduced errors. Applicants can use digital tools to access and manage their application information. This provides flexibility in managing the application and reduces the need for physical documents.

Some insurers might use a combination of paper and online methods. This could include a preliminary online application followed by a physical signature and documentation.

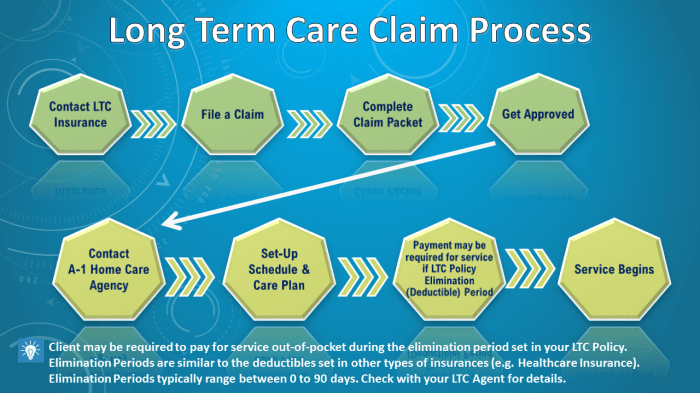

Steps in the Application Process

The application process should be broken down into a series of clear steps, each with precise instructions. A numbered list or a step-by-step guide can be provided to make the process more user-friendly.

- Step 1: Gather required documents. This includes personal identification, medical records, and financial statements. Ensure all documents are accurate and complete.

- Step 2: Review the application form carefully and complete all sections with the necessary details. Be mindful of any deadlines or submission requirements.

- Step 3: Submit the completed application form through the designated method, whether online, by mail, or in person. Confirm receipt of the application for your records.

- Step 4: Review the application’s progress periodically, and contact the insurer if needed. Keep track of any communication from the insurance company.

Frequently Asked Questions (FAQ)

A comprehensive FAQ section can address potential concerns and provide clarification on common questions. A searchable database of frequently asked questions (FAQs) can be helpful for applicants. This allows them to quickly find answers to their queries. An example is a section dedicated to explaining various terms and concepts related to long-term care insurance.

Financial Considerations

Understanding the financial aspects of long-term care insurance is crucial for making informed decisions. This section details how to present financial information clearly, focusing on premiums, benefits, and coverage amounts, and providing various payment options. We’ll also explain why avoiding complex jargon is essential for clear communication.This section helps applicants grasp the financial implications of long-term care insurance without overwhelming them with technical details.

We aim to present the information in a way that’s easily understandable and allows for a transparent comparison of different options.

Presenting Financial Information Clearly

Presenting financial information in a straightforward manner is key. Avoid technical terms and use everyday language. Use clear and concise language to explain premium costs, benefits, and coverage amounts. For example, instead of saying “actuarial calculations,” say “estimated costs.” Focus on the overall cost of the policy, not just the initial premium.

Examples of Clear Language, Long term care insurance applications must contain plain and unambiguous

Here are examples of clear language for different financial aspects:

- Premium: “Your monthly premium will be $XXX.” Do not use terms like “actuarial present value” or “expected future costs”. Instead, be direct and precise.

- Benefits: “The policy covers up to $YYY per month for care services.” Avoid complicated formulas or detailed calculations. Instead, present the coverage amounts clearly and concisely.

- Coverage Amount: “This policy provides a maximum coverage of $ZZZ for a total of 5 years.”

Payment Options

Different payment options are available for long-term care insurance. This section provides an overview of these options to help applicants choose the best fit for their needs.

| Payment Option | Explanation |

|---|---|

| Monthly Premium | A fixed amount paid each month. This is the most common payment method. |

| Annual Premium | A fixed amount paid annually. This option might offer a slightly lower cost per unit of coverage compared to monthly payments. |

| Single Premium | A lump-sum payment made upfront. This method can sometimes lead to a lower overall cost for the policy, especially if the policy is purchased at a younger age, but there is no flexibility to adjust or cancel coverage. |

| Other Payment Options | In some cases, a financial institution or bank may allow the option of financing or paying with a loan. However, there may be additional fees or interest charges for this type of arrangement. |

Avoiding Complex Jargon and Calculations

Complex financial jargon and calculations can be confusing for applicants. Use plain language to explain costs and avoid technical terms. Instead of focusing on complex formulas, highlight the overall cost and benefits. Focus on providing clear, concise explanations of potential costs, without getting into the intricate details. For instance, instead of providing a detailed actuarial calculation, provide a simple breakdown of estimated costs over the policy’s term.

Clear Explanations of Potential Costs

Clearly explaining potential costs is crucial. Explain any fees, commissions, or other charges upfront. Provide a summary of the total estimated costs over the policy’s duration, making it easy to compare different options. This will help applicants make informed decisions and understand the overall financial commitment.

Customer Communication

Keeping you informed about your long-term care insurance policy is crucial. Clear and consistent communication builds trust and helps you understand your coverage. This section Artikels how we communicate policy details, changes, and updates.Effective communication is key to understanding your policy and making informed decisions. This includes clear explanations of policy terms, examples of how policy changes are communicated, and readily available resources for referencing policy information.

Communicating Policy Details Clearly

Policy details should be presented in a straightforward and easily understandable manner. Avoid jargon or technical terms whenever possible, and use plain language. The use of analogies and illustrative examples can help explain complex concepts in a more accessible way. For instance, a policy’s benefit amount could be explained as being enough to cover a year’s worth of assisted living costs.

This approach makes the policy’s implications more tangible and relatable to the average person.

Examples of Policy Changes and Updates

Communicating policy changes and updates promptly and transparently is essential. Changes to premiums, coverage amounts, or benefit periods should be communicated in writing, ideally via email or mail, and also highlighted on your online account portal, where applicable. For example, a notice about a 5% increase in premiums would include the effective date, the reason for the change, and a clear explanation of how the increased premium would affect your monthly payments.

The communication should clearly Artikel the next steps to be taken by the policyholder, such as requesting a review or appealing the change.

Common Policy Terms and Definitions

Understanding the terms used in your long-term care insurance policy is critical. Here’s a quick reference guide to common terms:

| Term | Definition |

|---|---|

| Benefit Period | The duration of time your policy covers care. |

| Premium | The amount you pay regularly to maintain your policy. |

| Waiting Period | The time between when you apply for and when you receive coverage. |

| Exclusions | Specific conditions or situations that are not covered by your policy. |

| Limitations | Restrictions on the types or extent of care your policy covers. |

Importance of Regular and Clear Communication

Regular and clear communication about your policy is essential. This includes providing updates on claims, policy changes, and any relevant legislative or regulatory updates. Consistent communication ensures that you are always informed about your coverage, avoiding misunderstandings or surprises. Knowing about potential changes in the policy can allow you to prepare for them.

Illustrative Examples for Complex Policy Concepts

Illustrative examples can greatly enhance understanding of complex policy concepts. Imagine a scenario where a policyholder needs long-term care due to a chronic illness. The policy’s benefits can be demonstrated by outlining how the policy covers a portion of the costs of nursing home care. Such examples can illustrate how your policy could work in practical situations.

Wrap-Up

In conclusion, ensuring clarity and precision in long-term care insurance applications is not just a best practice, it’s a necessity. By employing plain language, defining coverage meticulously, and clearly outlining exclusions and limitations, insurance providers can cultivate trust and foster a deeper understanding of the policies. This ultimately leads to a more satisfying and informed decision-making process for all parties involved.

FAQ Overview

What are some common pitfalls to avoid when writing about pre-existing conditions?

Vague language or overly technical terms can create ambiguity. Instead, use precise and straightforward language, avoiding jargon or overly complex phrasing. Clearly define the criteria for pre-existing conditions and how they might affect coverage.

How can I ensure my application forms are easy to understand?

Employ clear and concise instructions for each section. Use simple, everyday language. Organize the form logically with clear headings and subheadings. Provide examples, where applicable, to illustrate expectations. Use a logical flow, guiding the applicant through the process.

What is the importance of clear communication regarding policy changes and updates?

Maintaining open and transparent communication about policy changes and updates builds trust and demonstrates respect for the policyholder. Use simple, easily understandable language, and provide ample time for policyholders to adjust to any changes.

How can I avoid misleading language in describing limitations?

Use specific and concrete examples to illustrate the limitations. Avoid vague or ambiguous phrases. Clearly state the circumstances under which coverage will not apply, using precise language and avoiding jargon. Emphasize the importance of reading the entire policy document.