I’m on food stamps debit collection, and now what? This guide offers a comprehensive look at navigating the complexities of food stamp debit collection. We’ll explore the causes, your rights, debt management strategies, and ways to prevent future issues. Understanding your options is key to effectively managing this situation.

Food stamp debit cards are a vital resource for many families, but unfortunately, situations can arise leading to collection activity. This guide aims to provide clarity and practical steps to address these issues, protecting your financial well-being.

Understanding the Issue

Food stamp debit collection, often arising from unpaid balances on Supplemental Nutrition Assistance Program (SNAP) benefits, presents a significant financial challenge for many individuals and families. These collections can quickly escalate, impacting not only current financial stability but also future opportunities. Understanding the intricacies of this process is crucial for navigating the potential pitfalls and developing strategies to resolve the debt effectively.Food stamp debit card collections stem from a variety of circumstances, from unintentional errors to complex financial situations.

A thorough comprehension of the contributing factors and available resources can empower individuals to address these issues proactively.

What Food Stamp Debit Collection Entails

Food stamp debit card collections involve the recovery of outstanding balances owed on SNAP benefits. This process typically begins with a notice from the agency responsible for administering SNAP benefits. The notice Artikels the amount owed, the required payment plan, and the consequences of non-payment. The debt is often pursued through various means, including wage garnishment, bank account levies, and negative reporting to credit bureaus.

Ways a Person Might Find Themselves in This Situation

Instances of food stamp debit collection can arise from a variety of factors. Errors in benefit calculation or administration, including clerical mistakes or inaccurate reporting of income or household size, can lead to overpayments that need to be recouped. Failure to return or properly account for excess benefits can also trigger collections. Financial hardship or unexpected events such as job loss or medical emergencies can sometimes cause temporary inability to meet repayment obligations.

Potential Reasons for Food Stamp Debit Card Collection

Several factors can lead to the accrual of debt on a food stamp debit card. Errors in benefit calculations, like a failure to adjust for changes in household size or income, can result in overpayments. Intentional misuse of the card, including unauthorized purchases or fraudulent activities, is another contributing factor. Furthermore, failure to promptly report changes in circumstances, such as job loss or a change in income, can result in the accumulation of outstanding balances.

It is essential to understand the specific reason for the collection to develop an appropriate repayment plan.

Financial Burdens Associated with Collections

Food stamp debit collections can have a significant impact on a person’s financial well-being. The debt itself represents a substantial financial burden, requiring immediate repayment. Collection activity can create additional financial stress through the potential for wage garnishment or other financial penalties. The negative impact on credit scores can further hinder future financial opportunities. This can manifest as difficulty obtaining loans, rental housing, or even employment.

Consequences of Failing to Address the Debt

Failure to address food stamp debit collection can have serious consequences. These consequences can include wage garnishment, which directly impacts income. The debt can be reported to credit bureaus, damaging credit scores and potentially making it challenging to secure loans or credit in the future. In extreme cases, collection agencies may take legal action, leading to additional legal fees and potentially more severe financial repercussions.

It’s crucial to address the debt promptly to mitigate these consequences.

Rights and Resources

Facing food stamp debit collection can be a stressful experience. Understanding your rights and available resources is crucial for navigating this process effectively. Knowing how to utilize these resources can help alleviate the burden and potentially resolve the issue.Navigating the complexities of food stamp debit collection requires a comprehensive understanding of your rights and the resources available to assist you.

This section details the legal protections you have, Artikels avenues for dispute resolution, and provides contact information for relevant agencies and organizations. Knowing your rights and accessing the proper resources can empower you to effectively address the collection issue and protect your access to vital food assistance.

Rights of Individuals Facing Food Stamp Debit Collection

Individuals facing food stamp debit collection have specific rights. These rights aim to ensure fair treatment and provide avenues for resolving issues. The most critical rights often include the right to challenge inaccuracies in the debt, to request documentation supporting the collection, and to appeal decisions. These rights are designed to prevent unwarranted deductions and ensure that collection procedures adhere to established legal guidelines.

Available Resources for Resolving Food Stamp Debit Collection Issues

Several government agencies and non-profit organizations offer assistance in resolving food stamp debit collection issues. These resources provide guidance, support, and advocacy for individuals facing these challenges. These resources offer a range of services from information dissemination to direct intervention in collection cases.

Government Agencies Offering Assistance

The Supplemental Nutrition Assistance Program (SNAP) is the primary federal program responsible for food stamp benefits. Local SNAP offices often have dedicated staff to help resolve issues related to debit collection. Contacting your local SNAP office is often the first step in addressing the issue. Other relevant government agencies might include the Consumer Financial Protection Bureau (CFPB) and the Department of Agriculture (USDA).

These agencies can provide guidance on your rights and assist in navigating the collection process. For specific assistance, it is recommended to consult the relevant websites of these organizations.

Non-Profit Organizations Offering Assistance

Several non-profit organizations specialize in assisting low-income individuals and families. These organizations may provide legal aid, advocacy, and financial counseling. Many of these organizations have experience working with individuals facing food stamp debit collection issues. For a list of organizations in your area, it is helpful to search online or contact local community centers. These organizations often have volunteer attorneys who can help with debt disputes.

Process of Contacting Agencies and Organizations

Contacting government agencies or non-profit organizations often involves researching their websites for contact information. Locating local offices is vital. The process might include phone calls, online inquiries, or in-person visits. Be prepared to provide necessary information, such as your case number, name, and contact details.

Disputing a Food Stamp Debit Collection

Disputing a food stamp debit collection typically involves a formal process. This process may involve gathering documentation, contacting the agency responsible for the collection, and providing evidence to support your claim. It is essential to meticulously document every step and keep records of all correspondence. This detailed record-keeping is vital to support your case. Maintaining meticulous records of all communications and supporting documents is essential.

Debt Management Strategies

Managing food stamp debit collection debts requires a proactive and strategic approach. Ignoring these debts can lead to escalating issues, including negative impacts on your credit score and potential legal action. A structured debt management plan is crucial for resolving these issues effectively and minimizing long-term consequences.Effective debt management involves a combination of understanding your obligations, developing a budget, and actively negotiating with collection agencies.

This process requires discipline, patience, and a commitment to consistent action. By following a step-by-step approach and maintaining detailed records, you can significantly improve your chances of successfully managing these debts.

Step-by-Step Guide for Managing Food Stamp Debit Collection Debts

This guide provides a structured approach to managing food stamp debit collection debts. Each step is critical in resolving the debt effectively and efficiently.

- Assess the Situation: Determine the total amount owed, the collection agency involved, and the terms of the debt. Gather all relevant documentation, such as letters, notices, and any previous communication with the agency.

- Create a Budget: Develop a detailed budget outlining your income and expenses. Identify areas where you can reduce spending to allocate more funds towards debt repayment. Prioritize essential expenses and find ways to cut back on non-essential items.

- Negotiate with Collection Agencies: Contact the collection agency to inquire about possible payment plans or arrangements. Be prepared to explain your financial situation and request a reduction in interest or fees, if applicable. Be polite and professional in your communication.

- Establish a Payment Plan: Work with the collection agency to agree on a realistic and manageable payment plan. Ensure the plan aligns with your budget and allows for consistent payments without undue financial strain.

- Maintain Accurate Records: Keep detailed records of all communication, payments, and agreements with the collection agency. This documentation is essential for tracking progress and resolving any disputes.

- Monitor Your Progress: Regularly review your progress towards debt repayment and make adjustments to your plan as needed. Stay informed about any changes in terms or requirements from the collection agency.

Strategies for Negotiating with Collection Agencies

Negotiation with collection agencies requires a strategic approach. Clear communication and a well-defined strategy significantly improve the chances of success.

- Be Prepared to Explain Your Situation: Clearly Artikel your financial circumstances, including your income, expenses, and any extenuating circumstances that may have contributed to the debt. Be honest and transparent.

- Request a Written Agreement: Once a payment plan is agreed upon, ensure it’s documented in writing. This protects both you and the collection agency from misunderstandings and future disputes. Review the agreement carefully before signing.

- Be Persistent but Professional: Follow up with the agency regularly, but maintain a professional and respectful tone in all communications. Do not engage in aggressive or confrontational behavior.

- Verify Agency Authority: Before making any payment arrangements, ensure the collection agency has the proper authority to accept payments. Inquire about the legal basis of their collection efforts.

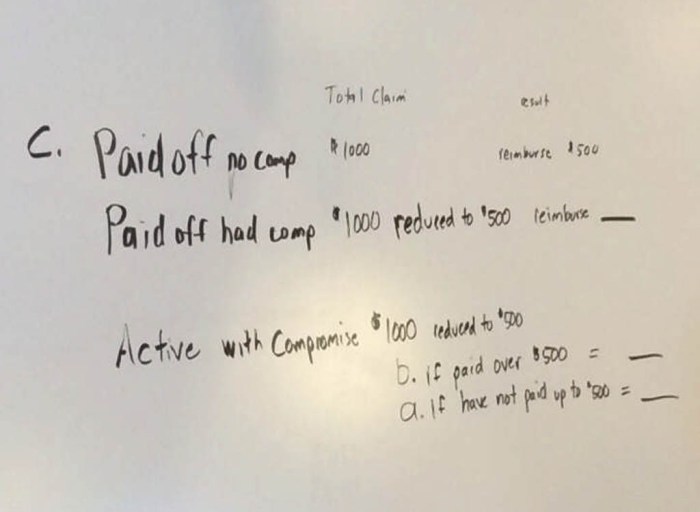

Examples of Potential Payment Plans or Arrangements

Payment plans are tailored to individual circumstances. Common examples include:

| Plan Type | Description |

|---|---|

| Fixed Monthly Payment | A set amount paid each month until the debt is resolved. |

| Reduced Interest/Fees | Agreement to reduce interest or fees on the outstanding balance. |

| Shortened Repayment Term | Agreement to reduce the overall repayment period. |

| Debt Consolidation | Combining multiple debts into a single, manageable payment. |

Importance of Maintaining Accurate Records

Maintaining detailed records is crucial for tracking progress and resolving any disputes. Comprehensive documentation is essential for demonstrating compliance with agreements and managing expectations.

Accurate records serve as proof of payment, communication, and agreements, ensuring smooth debt resolution.

Creating a Budget to Manage Debt

A budget is a crucial tool for managing debt effectively. It helps you allocate resources to prioritize debt repayment and prevent future financial strain.

- Track Income and Expenses: Record all sources of income and all expenses. Categorize expenses to identify areas where you can reduce spending.

- Prioritize Essential Expenses: Ensure essential expenses, such as housing, food, and healthcare, are covered before allocating funds towards debt repayment.

- Identify Areas for Savings: Examine your spending habits and identify areas where you can reduce or eliminate unnecessary expenses to increase your debt repayment capacity.

- Adjust the Budget as Needed: Regularly review and adjust your budget to accommodate changes in income or expenses. Flexibility is key in effectively managing debt.

Preventing Future Issues

Avoiding future food stamp debit collection issues hinges on proactive measures and a thorough understanding of the program’s guidelines. Consistent adherence to these guidelines and responsible management of benefits are key to avoiding future problems. This section Artikels strategies to prevent future issues, including common causes, the importance of accurate reporting, and methods for responsible benefit usage.Understanding the potential pitfalls associated with food stamp benefits is crucial.

By addressing these issues proactively, individuals can ensure the smooth and continuous receipt of these essential resources.

Common Causes of Debit Collection Issues

A significant number of debit collection issues stem from a failure to meet program requirements. These issues often arise from a combination of factors, including inaccurate reporting, overspending, and misuse of benefits. Common causes include:

- Incorrect or Late Reporting of Income and Expenses: Failure to report changes in income or expenses promptly can trigger discrepancies in benefit calculations, leading to overpayments or underpayments, ultimately resulting in debt.

- Overspending or Misuse of Benefits: Exceeding allowable spending limits or using benefits for non-eligible purposes can trigger debit collection. This often involves purchasing non-essential items or exceeding established spending patterns.

- Failure to Meet Eligibility Requirements: Maintaining eligibility requirements is essential. Any change in circumstances, such as a change in household size or employment status, must be reported promptly to avoid losing benefits or incurring debt.

- Incorrect Documentation or Paperwork: Errors in submitting required documents or forms can lead to delays in processing benefits or inaccurate benefit calculations. This can result in unexpected deductions or debt.

Importance of Accurate Reporting of Income and Expenses

Accurate reporting of income and expenses is fundamental to maintaining eligibility and avoiding debt. It ensures that benefits are calculated correctly, preventing overpayments or underpayments.Maintaining accurate records of income and expenses is vital. Detailed records can facilitate prompt reporting of any changes, avoiding potential discrepancies and associated penalties. Regular review of these records is recommended to identify and address any inconsistencies early on.

This practice allows for quick corrections, preventing the accumulation of errors and subsequent debt.

Strategies for Avoiding Overspending or Misuse of Benefits

Developing responsible spending habits and adhering to program guidelines are crucial for avoiding overspending or misuse of benefits. A well-defined budget can help to control spending and avoid overextending available resources.

- Creating a Budget: A detailed budget outlining expected income and expenses can help to prioritize spending and prevent overspending. A budget allows for a realistic assessment of available funds and helps to prevent exceeding the allocated amount for food purchases.

- Prioritizing Essential Expenses: Ensuring essential expenses, such as rent, utilities, and medical care, are met before allocating funds for discretionary spending, can significantly reduce the risk of overspending.

- Identifying Non-Essential Purchases: Careful consideration of purchases should focus on the necessity of items. Understanding that not all purchases are essential can help to prevent misuse of benefits and associated debt.

- Using Benefits for Intended Purposes: Benefits are designed for purchasing food. Using benefits for non-food items can result in overspending and debt. It’s crucial to adhere to the program guidelines and use benefits solely for eligible food items.

Potential Pitfalls and How to Avoid Them

Several pitfalls can lead to future food stamp debit collection issues. Proactive measures can help to mitigate these risks.

Navigating food stamp debit collection can be challenging, but a healthy and satisfying snack can help. Consider trying a protein chocolate chip cookie recipe as a delicious alternative to sugary treats. Finding recipes like protein chocolate chip cookies recipe can be a budget-friendly way to add nutritional value to your diet, even while managing food stamp debit collection.

- Ignoring Notifications: Regularly reviewing notices and communications regarding benefit changes is crucial. Ignoring these notifications can lead to errors in benefit calculations and debt accumulation. Promptly addressing any issues or concerns is essential.

- Lack of Communication: Open communication with program representatives is vital. Communicating any changes in circumstances or concerns about benefit calculations can help resolve issues before they escalate into debt. This proactive approach is essential to maintain good standing with the program.

- Neglecting to Update Information: Keeping records of income and expenses updated and accurate is crucial for avoiding future issues. Failure to update information when changes occur can lead to overpayments or underpayments and associated debt.

- Failure to Seek Assistance: If encountering difficulties in managing benefits, seeking assistance from qualified agencies or support groups is crucial. This proactive approach can provide valuable guidance and resources to help resolve issues and prevent future problems.

Impact on Finances

Food stamp debit collection can significantly impact an individual’s financial well-being, affecting their credit score, overall debt burden, and long-term financial stability. Understanding the potential consequences of non-payment is crucial for navigating these challenges effectively. This section will detail the financial repercussions of food stamp debit collection, highlighting the impact of various debt collection practices and the long-term consequences of unpaid debts.Debt collection practices, whether for food stamps or other debts, can have a detrimental effect on creditworthiness.

A negative entry on a credit report due to late or non-payment can severely hinder future financial opportunities. The specific impact depends on the severity and duration of the delinquency.

Financial Impact on Credit Score

A negative entry on a credit report, resulting from late or non-payment of food stamp debts, can significantly lower a credit score. This lower credit score can make it difficult to secure loans, rent an apartment, or even obtain a cell phone contract. Lenders and other financial institutions use credit scores to assess risk, and a poor score suggests a higher risk of default.

A lower credit score can also increase interest rates on future loans and credit cards. Examples include higher interest rates on mortgages, car loans, and credit cards.

Comparison of Debt Collection Practices, I’m on food stamps debit collection

Various debt collection practices can have differing impacts on an individual’s finances. Some collection agencies may be more aggressive than others, leading to more significant negative consequences on a credit report and potentially resulting in legal action. The severity of the consequences is often directly proportional to the severity of the collection action and the individual’s response to the debt.

For instance, a simple late payment might result in a negative entry, while repeated non-payment could lead to legal proceedings.

Potential Negative Effects of Non-Payment

Delayed or non-payment of food stamp debts can have severe repercussions on an individual’s financial well-being. The table below Artikels some potential negative impacts.

| Issue | Impact | Mitigation |

|---|---|---|

| Late Payment | Negative credit report entry, potentially impacting future creditworthiness, making it harder to obtain loans or rent housing. | Contact the agency for payment plans, which often avoid negative credit report entries. |

| Non-payment | Increased debt due to accumulating interest and penalties, potential for legal action, including wage garnishment or bank levies, and further damage to creditworthiness. | Seek assistance from consumer credit agencies, debt consolidation services, or legal aid organizations. These can provide guidance on developing a payment plan and navigating legal procedures. |

Long-Term Consequences of Unpaid Food Stamp Debts

Unpaid food stamp debts can have lasting and far-reaching consequences. A negative credit history can persist for several years, affecting an individual’s ability to secure favorable financial terms. This can translate into higher interest rates on loans, difficulties renting housing, and limitations on access to essential services. For example, an individual with a poor credit history might be denied a mortgage, leading to significant financial strain and impacting their ability to own a home.

Furthermore, persistent non-payment could result in further legal action, potentially leading to wage garnishment, which severely impacts an individual’s income and ability to meet other financial obligations.

Practical Advice

Addressing food stamp debit collection requires a proactive and strategic approach. This section provides actionable steps and crucial resources to navigate the process effectively. Understanding your rights and responsibilities is paramount to minimizing the impact of these collections on your overall financial well-being.Effective strategies for managing food stamp debit collection often involve a combination of communication, financial planning, and potentially legal assistance.

By implementing these strategies, individuals can work towards resolving the issue and preventing future problems.

Key Points Summary

This section highlights the essential steps for handling food stamp debit collection, emphasizing the importance of timely action and proactive communication. Proactive communication and adherence to established procedures are crucial in resolving these issues efficiently.

Actionable Steps

Taking immediate action is vital when facing food stamp debit collection. A clear plan of action will help manage the situation effectively.

- Contact the Food and Nutrition Service (FNS) immediately: This is the first step to understanding the specifics of the debt and available options. The FNS can provide information on payment plans, potential waivers, or dispute resolution processes. Understanding the details of the debt, such as the amount owed, due dates, and interest rates, is essential to developing a viable plan.

- Create a budget: Accurately tracking income and expenses is critical for understanding your financial situation. Identify areas where you can reduce spending or increase income to allocate funds for debt repayment.

- Explore payment plans: Many agencies offer payment plans to manage debt obligations. These plans can spread out payments, making them more manageable. Thoroughly investigate the terms and conditions of any payment plan to ensure it aligns with your financial capabilities and expected repayment schedule.

- Seek legal assistance if needed: If you’re unsure about your rights or the debt collection process, consulting with a legal aid organization or attorney can provide valuable guidance. This is especially important if you believe the debt is inaccurate or the collection procedures are improper.

Essential Resources and Contacts

Accessing the right resources can greatly assist in resolving food stamp debit collection issues.

| Resource | Contact Information | Description |

|---|---|---|

| Food and Nutrition Service (FNS) | (Insert website link here) and (Insert phone number here) | Government agency for food assistance; provides information on benefits, eligibility, and debt resolution options. |

| Local Legal Aid Organizations | (Insert website link here) and (Insert phone number here) | Offer free or low-cost legal assistance to those facing financial difficulties, including debt collection issues. |

| Consumer Protection Agencies | (Insert website link here) and (Insert phone number here) | Provide information on consumer rights and debt collection practices. They may offer guidance on resolving issues or filing complaints. |

Seeking Professional Help

Seeking professional help when facing complex debt situations, such as food stamp debit collection, can significantly increase your chances of a favorable outcome. A legal professional can offer specialized advice and representation to navigate the legal complexities of the situation. It is important to consult with legal aid or an attorney, particularly if you suspect that the debt is inaccurate or if the collection methods are inappropriate.

This ensures you understand your rights and the best course of action to protect your financial well-being.

Navigating food stamp debit collection can be challenging. Understanding the process and resources available is crucial. For those needing support and guidance, Crawford Ray Funeral Home in Canton, North Carolina, crawford ray funeral home canton north carolina , offers compassionate support during difficult times. Ultimately, residents facing food stamp debit collection should seek appropriate assistance programs to resolve the issue.

Illustrative Case Studies: I’m On Food Stamps Debit Collection

Understanding the complexities of food stamp debit collection requires examining real-world scenarios. These case studies demonstrate the potential challenges and highlight effective strategies for navigating these situations. They offer valuable insights into resolving debt, preventing future issues, and maximizing financial well-being.

Food Stamp Debit Collection Case Study 1

A single mother, Sarah, relied on food stamps to support her two children. Due to unforeseen circumstances, she experienced a temporary lapse in employment, resulting in an inability to make timely payments on her outstanding food stamp balance. This led to debit collection actions by the state.Sarah initially felt overwhelmed and unsure of her options. She contacted the food stamp agency and explained her situation.

The agency, recognizing the extenuating circumstances, worked with Sarah to develop a payment plan that aligned with her reduced income. This plan involved a lower monthly payment amount and an extended repayment period.The outcome demonstrated the importance of open communication and proactive problem-solving. Sarah successfully avoided further penalties and maintained her food stamp benefits. The lesson learned was that seeking assistance and creating a realistic repayment plan can alleviate the stress and financial strain of debt collection.

Successful Debt Management Strategy Case Study 2

John, a recent college graduate, faced student loan debt and unexpected medical expenses. His initial approach involved consolidating his debt, reducing his interest payments, and prioritizing high-interest debts. He researched different debt management programs and considered debt consolidation options.By implementing a budget that allocated a specific amount for debt repayment each month, John managed to pay off his debts significantly faster.

He actively monitored his spending, avoiding unnecessary expenses, and increased his income through part-time work.The outcome illustrated the effectiveness of a comprehensive debt management strategy that combined proactive budgeting, debt consolidation, and increased income. The lesson learned was that careful planning and consistent effort are crucial for successful debt management.

Early Intervention Case Study 3

Emily, a young adult, received a notice of food stamp debit collection. She immediately sought assistance from a local non-profit organization offering financial literacy programs. The organization helped her understand the consequences of non-payment and provided strategies to manage her financial situation effectively.Through workshops and one-on-one counseling, Emily learned about budgeting, debt management techniques, and credit building. She also developed a realistic budget and created a plan to improve her financial situation.The outcome showcased the importance of early intervention.

By addressing the issue proactively, Emily avoided significant financial hardship and learned valuable life skills for future financial well-being. The lesson learned was that seeking help early on can prevent accumulating debt and empower individuals to take control of their finances.

Last Word

In conclusion, dealing with food stamp debit collection requires careful planning and proactive steps. Understanding your rights, exploring available resources, and implementing effective debt management strategies are crucial. By taking these steps and seeking help when needed, you can effectively address the situation and protect your financial future.

FAQs

What are the common reasons for food stamp debit collection?

Common reasons include missed payments, errors in reporting income or expenses, or overspending. It’s important to carefully review your benefits statements and account activity to identify any discrepancies.

How can I dispute a food stamp debit collection?

Contact the agency or organization responsible for the collection. They can provide information about their dispute resolution process. Be prepared to document any errors or inaccuracies that led to the debt.

What resources are available to help me manage food stamp debt?

Several government agencies and non-profit organizations provide assistance. The Food and Nutrition Service, and local legal aid centers are potential resources.

How does food stamp debt affect my credit score?

Unpaid food stamp debts can negatively impact your credit score, similar to other types of debt. Late payments or non-payment will appear on your credit report.