Republic Bank tax refund solutions letter: Navigating the complexities of tax refunds can be a real headache, especially when things go sideways. This guide breaks down the common problems, steps to take, and crucial strategies for resolving refund issues with Republic Bank. From understanding the reasons for delays to crafting a persuasive letter, we’ll equip you with the tools to get your refund quickly and efficiently.

This resource will delve into the various stages of the refund process, including filing, tracking, and resolving discrepancies. We’ll also offer practical examples and templates to help you effectively communicate with Republic Bank. Whether you’re facing a simple delay or a more significant problem, this guide provides a clear path forward.

Understanding Tax Refund Issues

Republic Bank customers may encounter various challenges related to their tax refunds. These issues can stem from complexities in the tax filing process, discrepancies between submitted information and the IRS records, or unforeseen delays. This section details common problems and provides solutions for Republic Bank customers.

Common Tax Refund Problems

Many Republic Bank customers experience delays or rejections of their tax refunds due to inaccuracies in the information submitted to the bank. These inaccuracies can arise from errors in the taxpayer’s tax return, issues with the bank’s processing of the refund, or even problems with the IRS itself. Understanding the potential sources of these issues is crucial for proactive problem-solving.

Reasons for Refund Delays or Rejection

Several factors can contribute to delays or rejections in tax refunds. These include:

- Incorrect or Incomplete Information: Errors in the taxpayer’s tax return, such as incorrect Social Security numbers, addresses, or bank account details, are a significant cause of refund problems. A simple typo can halt the entire process.

- Bank Processing Issues: Technical glitches, system overload, or human error within the bank’s refund processing system can lead to delays or rejection. This is less common but still a possibility.

- IRS Processing Delays: The IRS faces its own challenges in processing a massive volume of tax returns. Delays in IRS processing can impact the timeframe for Republic Bank to receive and process refunds.

- Matching Issues: Disagreements between the information provided by the taxpayer and the information on file with the IRS can cause the refund to be held up. This often arises when the taxpayer’s bank account details do not match the ones on their tax return.

Examples of Refund Issues

Consider these examples of common issues:

- A taxpayer submitted a tax return with an incorrect bank account number. This mismatch caused the refund to be rejected.

- A customer’s tax return was delayed due to a procedural error within Republic Bank’s system. This delay was resolved after the bank identified the issue.

- A taxpayer experienced a delay in their refund due to a prolonged hold by the IRS, related to a complex tax issue that required additional documentation.

Verifying Refund Status

Republic Bank customers can check the status of their refund by contacting Republic Bank directly or utilizing the online portal if available. This provides an up-to-date view of the processing stage of their refund. Customers should also keep an eye on any communication from the IRS, as this may contain crucial updates.

Importance of Accurate Records

Maintaining accurate records of tax filings and bank information is paramount for smooth tax refund processing. Keeping copies of tax returns, bank statements, and any correspondence with the IRS or Republic Bank helps in resolving issues swiftly if they arise.

Role of the IRS, Republic bank tax refund solutions letter

The IRS plays a crucial role in tax refund processing. While Republic Bank facilitates the refund disbursement, the IRS validates the taxpayer’s return and ensures compliance with tax laws. Issues within the IRS system, such as processing backlogs or technical problems, can directly affect the timeliness of refunds.

Typical Refund Delays and Possible Causes

| Typical Refund Delay | Possible Causes |

|---|---|

| Immediate Rejection | Incorrect or missing information on the tax return, or discrepancy between the taxpayer’s submitted bank details and the IRS’s records. |

| Moderate Delay (1-3 weeks) | Minor errors in the tax return, a minor hold by the IRS for clarification, or issues with bank account verification. |

| Significant Delay (3+ weeks) | More significant errors in the tax return, IRS processing backlogs, or complex tax situations requiring additional documentation from the taxpayer. |

Navigating the Refund Process: Republic Bank Tax Refund Solutions Letter

Republic Bank offers various avenues for taxpayers to file their tax returns and receive their refunds efficiently. This section details the process, timeline, requirements, and tracking mechanisms for a smooth refund experience.

Filing a Tax Return Through Republic Bank

Republic Bank facilitates tax return filing through partnerships with various tax preparation software providers and certified tax professionals. Customers can utilize these platforms to electronically file their returns, ensuring accuracy and timely submission.

Receiving a Tax Refund Through Republic Bank

The refund disbursement process varies based on the chosen method. For direct deposit, the refund is typically credited to the account specified during the filing process within a certain timeframe. For mailed checks, the refund is sent to the address provided in the tax return. Timing can vary depending on the method and the processing time of the IRS.

Refund Processing Timeline

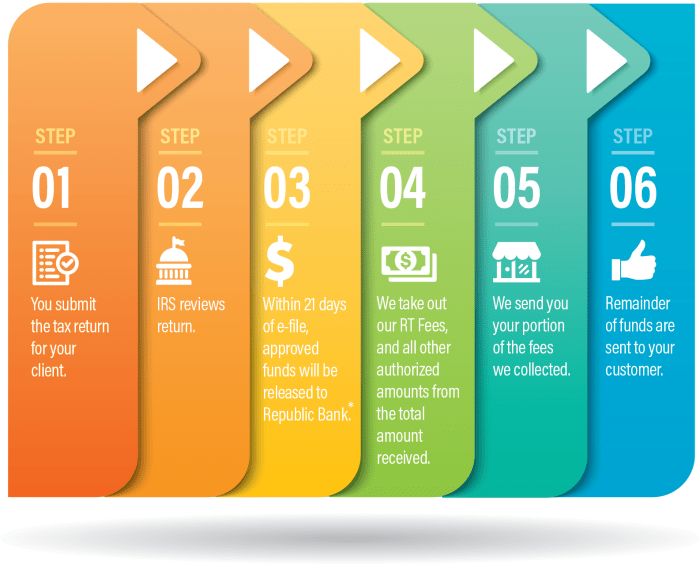

The typical refund processing timeline involves several stages, starting from the date of filing. A flowchart illustrating this process follows.

+-----------------+ | Filing Date | +-----------------+ | | v | +-----------------+ | IRS Processing | +-----------------+ | | v | +-----------------+ | Bank Verification| +-----------------+ | | v | +-----------------+ | Refund Credit | +-----------------+ | | v | +-----------------+ | Disbursement | +-----------------+

This flowchart depicts a general process; the exact timeframes for each step can differ based on various factors, such as the complexity of the return, IRS processing volume, and bank procedures.

For instance, a simple return might take less time than a complex one.

Requirements for Filing a Tax Return with Republic Bank

To file a tax return through Republic Bank, taxpayers typically need a valid tax identification number (TIN), accurate financial information, and supporting documentation. The specific documentation required may vary depending on the complexity of the return and the chosen tax preparation method. Contacting Republic Bank’s support team can provide clarity on these requirements.

Comparison of Filing Methods

The table below summarizes different tax return filing methods, highlighting their advantages and disadvantages.

| Filing Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Electronic Filing | Filing through online platforms or software. | Faster processing, potential for reduced errors, often free or low cost. | Requires internet access and familiarity with technology. |

| Paper Filing | Submitting paper tax forms to the IRS. | Potentially suitable for those unfamiliar with electronic filing. | Slower processing, increased risk of errors, potentially higher costs. |

| Professional Tax Preparation | Utilizing a certified tax professional. | Expertise and accuracy in complex returns, guidance on deductions. | Higher cost, potential for longer processing time. |

Tracking the Status of a Tax Refund

Republic Bank provides various methods for taxpayers to track their tax refund status. These methods include online portals, dedicated customer service phone lines, or email inquiries. By providing relevant information like filing date and TIN, customers can obtain updates on the progress of their refund.

Frequently Asked Questions (FAQs)

This section addresses common questions related to tax refunds through Republic Bank.

- What is the typical timeframe for receiving a tax refund? The time frame for receiving a refund depends on several factors, including the filing method, the IRS processing time, and Republic Bank’s internal procedures. For instance, direct deposit refunds are often received more quickly than mailed checks. Expect to receive your refund within the timeframe stated by Republic Bank and/or the IRS.

- How do I contact Republic Bank’s tax support team? Contacting Republic Bank’s support team can provide detailed information on filing procedures and refund tracking. Information about contact methods is available on Republic Bank’s website.

- What should I do if I encounter issues with my tax refund? Contact Republic Bank’s support team for assistance if you experience issues with your tax refund. They can provide guidance and support to resolve any problems.

Addressing Refund Discrepancies

Republic Bank provides various avenues for resolving discrepancies in tax refund processing. Understanding the procedures, required documentation, and communication channels is crucial for a smooth resolution. This section details the steps involved in disputing a refund and achieving a satisfactory outcome.

Resolving tax refund issues with Republic Bank requires a methodical approach. Proper documentation and clear communication are key to expedite the process and ensure a favorable resolution. This section Artikels the essential procedures, documentation, and contact options available to Republic Bank customers regarding tax refund problems.

Procedures for Resolving Tax Refund Issues

The first step in addressing a refund discrepancy is to meticulously review the initial tax refund information provided by Republic Bank. Compare the details with the original tax return filed to identify any discrepancies. Maintaining meticulous records of all communications and supporting documentation is critical. Prompt action is essential to resolve the issue swiftly.

Necessary Documentation for Disputing a Tax Refund

To initiate a refund dispute, gather comprehensive documentation. This includes copies of the original tax return, any supporting documents submitted with the return, and the Republic Bank tax refund statement. Include correspondence related to the refund issue. A clear statement outlining the specific nature of the discrepancy is crucial. This will help the bank understand the problem and focus the resolution efforts.

Contact Options for Tax Refund Problems

Republic Bank provides multiple channels for customers to contact regarding tax refund problems. These include a dedicated phone line, email address, and an online portal. Customers can choose the method that best suits their needs and communication style. Each method has its advantages in terms of speed and level of detail.

Examples of Correspondence Letters

A formal letter clearly outlining the problem, the supporting documents, and the desired resolution is important. For example, a letter might state: “Dear Republic Bank, I am writing to dispute tax refund [Refund ID Number]. The refund amount of [Amount] is incorrect. My original tax return [Tax Year] is attached for reference. I request a review and correction of the refund amount.”

Approaches to Resolving a Tax Refund Issue

Several approaches can be taken to resolve a tax refund issue with Republic Bank. These include direct communication, providing additional supporting documentation, and escalating the issue to a supervisor. Each approach has its own merits, and the most suitable approach depends on the complexity of the issue and the response received from Republic Bank.

Efficiency of Communication Channels

The efficiency of various communication channels for resolving refund problems varies. Phone calls often allow for immediate clarification and can resolve issues quickly, but email correspondence might be preferred for complex cases. A dedicated online portal might offer a more efficient tracking system for refund status updates.

Typical Timeframe for Resolving Tax Refund Issues

The time it takes to resolve a tax refund issue can vary significantly depending on the nature of the discrepancy and the bank’s response time. A table illustrating the typical timeframe for resolving different types of issues is presented below.

| Type of Issue | Typical Timeframe |

|---|---|

| Minor Calculation Error | 1-2 weeks |

| Missing or Incorrect Document | 2-3 weeks |

| Major Discrepancy or System Error | 3-4 weeks |

Preparing a Formal Letter

A well-structured letter is crucial for effectively communicating your tax refund concerns to Republic Bank. A clear and concise letter, properly formatted and supported by evidence, significantly increases your chances of a favorable resolution. This section details the essential components of a formal letter, providing examples and templates to guide you through the process.

A formal letter requesting a tax refund or addressing a discrepancy should be professional, polite, and assertive. It should clearly state the issue, provide necessary details, and present supporting documentation. The tone should be focused on achieving a resolution, not on criticizing the bank’s procedures.

Sample Letter Format for Requesting a Tax Refund

This format provides a template for requesting a tax refund from Republic Bank. A professional tone is essential to ensure a positive response.

“`

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

Republic Bank

[Republic Bank Address]

Subject: Tax Refund Request – [Your Account Number]

Dear Republic Bank,

This letter formally requests a tax refund for the 2023 tax year. My account number is [Your Account Number]. The tax refund amount due is [Amount]. I have attached copies of [Supporting Documents, e.g., tax return, W-2 form, etc.].

Please investigate this matter and issue the refund promptly.

Sincerely,

[Your Signature]

[Your Typed Name]

“`

Key Elements of a Letter Requesting a Tax Refund

A well-structured letter includes essential details for a smooth process. These elements are critical to ensuring your request is properly understood.

- Your Contact Information: Include your full name, address, phone number, and email address. This allows the bank to contact you if needed.

- Date: The date the letter is written is crucial for tracking purposes.

- Recipient Information: Clearly state the recipient, Republic Bank, and their address. Include the specific department if known.

- Subject Line: A concise and descriptive subject line helps the recipient quickly understand the letter’s purpose.

- Clear Statement of the Issue: Clearly state the reason for the refund request. Be specific, avoiding vague language.

- Supporting Documents: Include copies of relevant documents such as tax returns, W-2 forms, or any other supporting evidence. Clearly state what documents are included and why they are relevant.

- Closing: Use a professional closing, such as “Sincerely,” followed by your typed name.

Template for a Letter Explaining a Tax Refund Discrepancy

This template Artikels the structure for addressing a tax refund discrepancy. It focuses on presenting your case clearly and concisely.

“`

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

Republic Bank

[Republic Bank Address]

Subject: Inquiry Regarding Tax Refund Discrepancy – [Your Account Number]

Dear Republic Bank,

This letter addresses a discrepancy in my 2023 tax refund. My account number is [Your Account Number]. The expected refund amount, per my tax return, is [Amount]. However, my bank statement shows a refund of [Amount Received].

I have attached copies of my tax return and bank statement as supporting evidence.

Please review this matter and provide a resolution.

Sincerely,

[Your Signature]

[Your Typed Name]

“`

Importance of Clarity and Conciseness

Clarity and conciseness are vital. Avoid jargon or overly complex language. Present your case in a straightforward manner, ensuring all necessary information is included without ambiguity. A well-organized letter is more likely to be processed efficiently.

Presenting Supporting Evidence Effectively

Clearly label and organize supporting documents. Highlight key details and explain how each document relates to the issue. Use concise explanations, making the purpose of each piece of evidence evident.

A faded letter, a Republic Bank tax refund solutions letter, promising a brighter future, yet tinged with the grey of unanswered queries. The looming wait feels endless, a hollow echo in the quiet room. Perhaps the vibrant energy of the upcoming Flaming Lips tour merch 2024 here could momentarily distract, a fleeting flash against the persistent gloom.

Still, the refund letter, a silent plea, remains, a testament to the lingering uncertainties.

Key Components of a Well-Structured Letter

This table Artikels the crucial elements of a well-structured letter for requesting a tax refund or addressing discrepancies.

| Component | Description |

|---|---|

| Sender Information | Your name, address, phone number, and email |

| Date | Date of letter |

| Recipient Information | Republic Bank’s name and address |

| Subject Line | Clear and concise description of the letter’s purpose |

| Statement of Issue | Clear explanation of the problem or discrepancy |

| Supporting Documents | Attached copies of relevant documents |

| Closing | Professional closing and signature |

Examples of Strong Opening and Closing Statements

Strong opening and closing statements are vital for making a lasting impression.

- Opening Statement Example: “This letter formally requests a tax refund for the 2023 tax year, referencing my account number [Your Account Number] and the amount due [Amount].”

- Closing Statement Example: “Thank you for your prompt attention to this matter. I look forward to receiving a resolution soon.”

Handling Correspondence

Responding effectively to Republic Bank correspondence regarding tax refunds is crucial for a smooth resolution. Proper handling ensures accurate information exchange, minimizes delays, and maintains a positive relationship with the bank. This section details best practices for handling correspondence, ensuring your refund claim is processed efficiently and effectively.

Best Practices for Responding to Correspondence

Effective communication is key to resolving tax refund issues. Responding promptly and professionally demonstrates respect and aids in a timely resolution. Always maintain a polite and professional tone, even when addressing concerns or discrepancies. Thorough documentation of all communication is essential for tracking progress and ensuring all points are addressed.

Essential Information in Responses

Responses to Republic Bank letters should include specific details to avoid misunderstandings. Include your account number, the tax year in question, and the specific refund issue being addressed. If referencing a previous letter, quote the letter’s reference number for clarity. Providing supporting documentation, such as tax return copies or relevant IRS notices, strengthens your case and expedites the process.

Maintaining a Record of Correspondence

Maintaining a detailed record of all correspondence is vital for tracking the refund process. This includes keeping copies of all letters sent to and from Republic Bank, along with any supporting documents. A dedicated file or folder specifically for the refund claim can help maintain organization. Date each piece of correspondence and note any actions taken. This comprehensive record will be invaluable in case of further inquiries or complications.

Common Types of Correspondence

| Type of Correspondence | Description |

|---|---|

| Request for additional information | The bank may need additional details to process your refund. |

| Notification of refund status update | The bank provides an update on the status of your refund. |

| Notice of discrepancies | The bank highlights potential issues with your refund claim. |

| Rejection of refund claim | The bank declines your refund claim. This requires a specific response outlining your reasons for appeal. |

Following Up on a Letter Requesting a Refund

If you send a letter requesting a tax refund, it’s essential to follow up. A follow-up letter should reiterate the original request, cite any previous correspondence, and request an update on the status of your claim. This demonstrates your continued interest and ensures the bank doesn’t overlook your request. Maintain a consistent follow-up schedule, without being overly aggressive.

A shadowed letter, a Republic Bank tax refund solutions letter, arrives, a whisper of hope lost in the gray. The moon, veiled in the 12th house of synastry, casts a long, melancholic shadow on the process. Frustration lingers, a heavy cloak draped over the mundane task, the promised relief dimming, just as the moon’s light fades.

Perhaps the refund will arrive, but the journey feels fraught with uncertainty, like a whispered secret lost in the echoing chambers of the night.

Importance of Communication Timeline

Keeping track of the communication timeline is crucial. Note the dates of each correspondence, including the date of your initial request, any follow-up letters, and the bank’s responses. This helps you anticipate processing times and identify potential delays. A clear timeline ensures accountability and helps you understand where you stand in the refund process.

Examples of Polite and Professional Responses

- Example 1 (Responding to a request for additional information): “Dear Republic Bank, Thank you for your letter dated [Date]. Please find attached copies of [Supporting Documents]. These documents should clarify the [Issue]. Thank you for your time and assistance.” This example clearly references the correspondence and provides the necessary documents.

- Example 2 (Following up on a request): “Dear Republic Bank, This letter follows up on my previous correspondence dated [Date] regarding my tax refund for [Tax Year]. I would appreciate an update on the status of my claim. My account number is [Account Number]. Thank you.” This example demonstrates a polite and professional follow-up, clearly referencing previous communication.

Closure

In conclusion, this comprehensive guide on Republic Bank tax refund solutions letter has covered the full spectrum of potential issues and provided actionable steps for resolving them. By understanding the process, maintaining meticulous records, and employing effective communication, you can significantly increase your chances of a smooth and successful refund experience. Remember, proactive communication and a well-structured letter are key to navigating these situations effectively.

We hope this resource proves invaluable in your journey to securing your tax refund.

Question & Answer Hub

What are some common reasons for a tax refund delay from Republic Bank?

Common reasons for delays include incorrect information on the tax return, issues with the IRS processing, or problems with the bank’s internal systems. Sometimes, simple errors like a missing signature can also cause delays.

How long does it typically take to resolve a tax refund discrepancy with Republic Bank?

The timeframe for resolving discrepancies varies. It often depends on the nature of the issue and the responsiveness of both parties. A simple error can be resolved quickly, while more complex problems may take longer.

What supporting documents should I include in my letter requesting a tax refund from Republic Bank?

Include copies of your tax return, any relevant correspondence with the IRS, and any documentation that proves the discrepancy. Specific supporting documentation will depend on the nature of the issue.

What are the best ways to follow up on a letter requesting a tax refund?

Maintain a record of your correspondence and follow up with Republic Bank periodically. Keep track of dates and be patient; expect a response in a reasonable timeframe, but also understand that sometimes processes take time.