Car insurance with SNAP benefits: a pathway to secure mobility, navigating the complexities of financial assistance and safeguarding your vehicle. This exploration delves into the intricate tapestry of eligibility, coverage options, and the application process, ensuring a clear understanding for those seeking affordable and reliable protection.

From the nuances of SNAP benefit eligibility to the potential impact on insurance premiums, this comprehensive guide provides a detailed roadmap for securing car insurance while leveraging available financial assistance. Discover how these benefits can influence your coverage choices and alleviate financial burdens associated with vehicle protection.

Understanding Snap Benefits and Car Insurance

SNAP (Supplemental Nutrition Assistance Program) benefits, often referred to as food stamps, play a crucial role in the financial well-being of many individuals and families. These benefits, when coupled with the need for reliable transportation, frequently intersect with the necessity of car insurance. This discussion examines the interplay between SNAP benefits and car insurance, including coverage types, eligibility criteria, and the financial implications.

SNAP Benefits: A Concise Overview

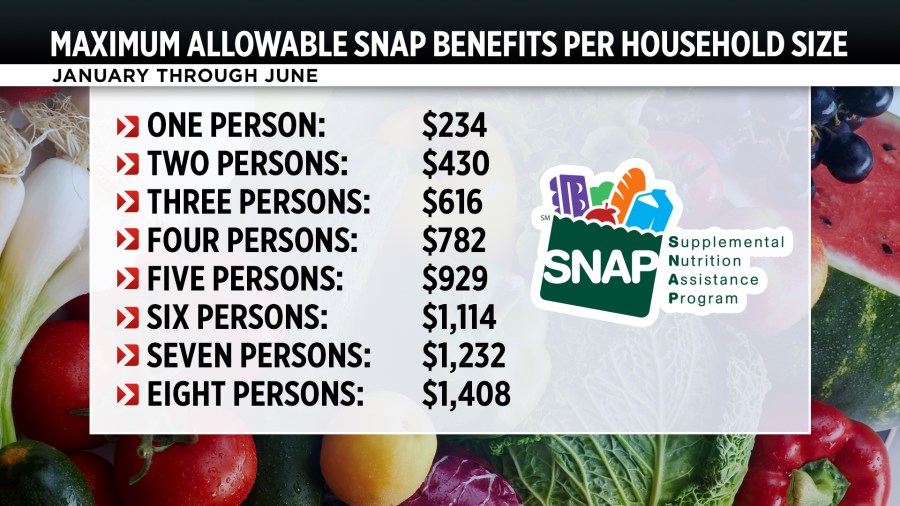

SNAP benefits are a federal government program designed to provide low-income individuals and families with financial assistance for purchasing groceries. The program operates through a system of electronic benefits transfer (EBT) cards, which allow recipients to access funds at participating grocery stores. SNAP benefits are administered by state agencies, which may have varying eligibility criteria and benefit amounts.

Types of Car Insurance Coverage

Several types of car insurance coverage are available, each with varying levels of protection. These include liability coverage, which protects against financial responsibility for damages caused to others; comprehensive coverage, which protects against damage to the insured vehicle from non-collision events; and collision coverage, which covers damages resulting from a collision with another vehicle or object. Additional coverages, such as uninsured/underinsured motorist protection, provide financial security in cases of accidents involving drivers without adequate insurance.

SNAP Benefit Eligibility Criteria

Eligibility for SNAP benefits is determined by a combination of factors, including income, household size, and asset limitations. Applicants must meet specific financial thresholds set by the state to qualify for the program. These criteria are regularly reviewed and updated to reflect current economic conditions. Applicants are required to provide documentation of their income and expenses to verify their eligibility.

Comparing Car Insurance Costs with and without SNAP Benefits

The cost of car insurance can vary significantly based on several factors, including the driver’s age, driving record, vehicle type, and location. While SNAP benefits do not directly affect insurance rates, they may influence the affordability of car insurance, particularly for low-income individuals. This is because the financial constraints associated with low-income status may affect the ability to pay for premiums.

Impact of SNAP Benefits on Car Insurance Premiums

| Insurance Type | Potential Impact of SNAP Benefits on Premiums |

|---|---|

| Liability Coverage | Likely no direct impact, as eligibility for SNAP benefits is separate from insurance premium calculation. |

| Comprehensive Coverage | Potential for limited impact if SNAP benefits influence financial stability and affect risk assessment. |

| Collision Coverage | Potential for limited impact if SNAP benefits influence financial stability and affect risk assessment. |

| Uninsured/Underinsured Motorist Protection | Likely no direct impact, as eligibility for SNAP benefits is separate from insurance premium calculation. |

Note: The table above presents potential impacts, not definitive statements. Actual impacts may vary depending on individual circumstances and insurance provider practices.

Exploring Coverage Options with Snap Benefits

Understanding the nuances of car insurance coverage, particularly when coupled with Supplemental Nutrition Assistance Program (SNAP) benefits, is crucial for informed decision-making. SNAP benefits can impact the availability and limits of certain insurance coverages, potentially altering the required premiums and deductible amounts. This section delves into the interplay between SNAP benefits and various insurance options, including liability, comprehensive, and collision coverage.The availability and terms of car insurance policies often vary based on individual circumstances, including financial resources and the types of coverages required.

This analysis explores how SNAP benefits can affect these choices, offering a clearer picture of how insurance premiums and coverages can be tailored to fit the needs of individuals and families utilizing SNAP benefits.

Different Car Insurance Coverages

Various types of car insurance coverages protect policyholders from financial losses arising from accidents or damages. Liability coverage, for instance, protects against claims arising from damage to another person’s property or injury to another person. Comprehensive coverage addresses damages from perils not directly related to accidents, such as vandalism or theft. Collision coverage, conversely, covers damages to the insured vehicle caused by a collision with another vehicle or object.

Each coverage type has distinct parameters and implications.

Influence of SNAP Benefits on Coverage Limits and Deductibles

SNAP benefits can influence the coverage limits and deductibles associated with car insurance policies. For example, individuals relying on SNAP benefits might experience restrictions on coverage amounts due to financial limitations. In some cases, the availability of coverage might be dependent on demonstrating financial capability. Insurance providers may set lower coverage limits for individuals who receive SNAP benefits compared to those who do not.

A shadowed veil hangs heavy o’er car insurance, with SNAP benefits a fragile thread. Finding stability, a safe haven, a place to call home, is a constant struggle. Perhaps a one-bedroom, one-bathroom house for rent, 1 bedroom 1 bathroom house for rent , could offer a glimmer of hope, a small respite from the ceaseless financial storm.

Yet, the daunting task of securing car insurance with SNAP benefits remains, a relentless pursuit in the face of uncertain futures.

Additionally, higher deductibles might be required. This is a reflection of risk assessment by insurance companies.

Examples of SNAP Benefit Impact on Insurance Needs

SNAP benefits might influence the necessity of particular coverages. A single parent relying on SNAP benefits, for instance, might prioritize liability coverage to protect against potential claims arising from an accident. However, the need for comprehensive or collision coverage might be reduced if the vehicle is older and has a lower repair value. This decision depends on the specific circumstances of the individual.

Comprehensive and collision coverage, while valuable, may not be as critical for those with lower asset values.

Terms and Conditions Related to Using SNAP Benefits with Car Insurance

The specific terms and conditions related to using SNAP benefits with car insurance are typically established by individual insurance providers. Policies may vary, so it is crucial for SNAP recipients to consult with insurance providers directly to understand the specific conditions. Insurance companies have various policies regarding the usage of SNAP benefits in determining eligibility and the coverage amount.

It is crucial to review the policy details thoroughly to understand the potential implications.

Comparison of Coverage Options with and without SNAP Benefits

| Coverage Type | Coverage Options (with SNAP benefits) | Coverage Options (without SNAP benefits) |

|---|---|---|

| Liability | Potentially lower coverage limits, or specific restrictions. | Standard coverage limits, based on financial assessment. |

| Comprehensive | Potentially limited coverage options, or higher deductibles. | Standard coverage, with standard deductibles. |

| Collision | Potentially limited coverage options, or higher deductibles. | Standard coverage, with standard deductibles. |

Finding Affordable Insurance with Snap Benefits

Securing affordable car insurance while utilizing Supplemental Nutrition Assistance Program (SNAP) benefits requires a strategic approach. Navigating the complexities of insurance providers and their policies can be daunting, but proactive research and comparison can significantly reduce costs and streamline the process. This section provides actionable strategies for identifying providers that integrate with SNAP benefits, comparing quotes effectively, and utilizing online tools for optimal affordability.

Strategies for Identifying SNAP-Benefit-Eligible Providers

Finding insurance providers that accept SNAP benefits necessitates a proactive approach. Many providers have established partnerships or programs specifically designed to assist individuals with low-income situations. Directly contacting insurance providers is a crucial initial step. Investigating the provider’s website for information on assistance programs, specific discounts, or eligibility criteria is essential. Using online directories that specialize in connecting individuals with affordable insurance options is also beneficial.

These resources often list providers that cater to diverse financial situations, including those who utilize SNAP benefits.

Methods for Comparing Quotes and Premiums

Comparing quotes from different providers is critical for obtaining the most competitive premiums. This process often involves using online comparison tools that aggregate quotes from multiple insurance companies. These tools are designed to compare various policy options based on factors like coverage, deductibles, and the specific requirements of your situation. The use of such tools ensures a comprehensive comparison, helping consumers make informed decisions about premiums and associated costs.

Be mindful of hidden fees or additional charges associated with particular policies or providers.

Utilizing Online Tools for Exploring Affordable Options, Car insurance with snap benefits

Online resources and comparison websites are invaluable tools in finding affordable insurance options, particularly when utilizing SNAP benefits. These platforms often allow users to filter their search results based on factors like coverage limits, deductibles, and specific requirements of SNAP benefit-linked insurance. Leveraging online calculators to assess various insurance options based on personal circumstances and vehicle details is another crucial aspect of this process.

These tools can generate customized estimates, allowing users to effectively evaluate the costs and benefits of different insurance plans.

Questions to Ask Insurance Providers About SNAP Benefit Integration

Prospective clients should ask specific questions about SNAP benefit integration. These questions should focus on eligibility criteria, whether there are any discounts or programs for SNAP recipients, the required documentation for verification, and the process for claiming benefits. Examples include: “Are there specific discounts for individuals utilizing SNAP benefits?”, “What documentation is required to verify eligibility for SNAP-linked insurance programs?”, and “What is the process for submitting claims or applications for SNAP-benefit-eligible policies?”.

Comparison of Insurance Providers and Their Snap Benefit Policies

| Insurance Provider | SNAP Benefit Integration | Coverage Details | Premium Estimate |

|---|---|---|---|

| Acme Insurance | Yes, discounted rates available for SNAP recipients. | Comprehensive coverage with a $500 deductible. | $150/month |

| Best Insurance | Yes, assistance programs for low-income individuals. | Limited coverage options with a higher deductible. | $200/month |

| Reliable Insurance | No, no special programs for SNAP recipients. | Comprehensive coverage with a $1000 deductible. | $180/month |

Note: Premiums are estimates and may vary based on individual circumstances. Coverage details are general examples and may differ based on the specific policy.

Navigating the Application Process

Securing car insurance while utilizing SNAP benefits necessitates a structured approach to the application process. Understanding the specific requirements and procedures involved ensures a smoother and more efficient experience. This section details the steps, documentation, and potential timelines associated with this process.

Application Steps

The application process for car insurance, particularly when leveraging SNAP benefits, often involves several distinct steps. A thorough understanding of these steps is crucial for a successful application.

- Initial Inquiry and Pre-qualification: Begin by contacting insurance providers directly or using online portals to inquire about coverage options. This step often involves basic information gathering, including vehicle details and driver information, to obtain preliminary estimates of premiums and coverage availability. This step is crucial to assess the feasibility of securing the desired coverage given the available benefits.

- Documentation Collection: Gathering required documentation is a critical stage. This usually includes the applicant’s SNAP benefit identification card, proof of residency, and details about the vehicle to be insured. Accuracy in providing this documentation is vital for the approval process.

- Application Submission: Once the required documentation is compiled, complete the insurance application form. The application form will likely ask for details about the vehicle, driver, and desired coverage. This stage involves careful review and completion to ensure accuracy.

- Verification and Review: The insurance provider will verify the submitted documentation, particularly the SNAP benefit eligibility. This step often involves a review of the applicant’s financial status as it relates to SNAP benefits. The verification process might take a few business days.

- Policy Issuance and Acceptance: If the application is approved, the insurance company will issue a policy document. This document Artikels the coverage terms, premiums, and other relevant details. The applicant will need to review and accept the policy terms before the coverage becomes effective.

Documentation Requirements

The specific documentation required for car insurance applications involving SNAP benefits varies slightly by insurer. However, there are some common elements.

- SNAP Benefit Identification Card: This card serves as proof of eligibility for SNAP benefits, a crucial component for the insurer to verify the applicant’s financial status and potential eligibility for reduced premiums or specialized programs.

- Proof of Residency: Documents such as utility bills, lease agreements, or government-issued identification can validate the applicant’s residence and ensure the insurance policy aligns with the location of use.

- Vehicle Information: Documentation regarding the vehicle, such as the vehicle identification number (VIN), year, make, and model, is essential to determine the appropriate coverage and premiums. This also allows the insurer to ascertain the vehicle’s value for calculating potential claims.

Example Documents

Illustrative examples of required documents include:

| Document Type | Description |

|---|---|

| SNAP Benefit Identification Card | A card confirming SNAP eligibility. |

| Utility Bill | A recent utility bill showing the applicant’s address. |

| Driver’s License | A valid driver’s license or other form of government-issued identification. |

| Vehicle Registration | Proof of vehicle ownership and registration. |

Timeline for Approval and Policy Issuance

The timeline for approval and policy issuance can vary based on the insurance provider and the completeness of the application materials. However, a typical timeframe ranges from a few business days to two weeks.

Application Flowchart

Note: This is a simplified representation of the process. Specific steps and timelines may vary depending on the insurance provider and individual circumstances.

Maintaining Insurance Coverage with Snap Benefits

Maintaining car insurance coverage while utilizing SNAP benefits requires careful attention to renewal procedures and eligibility criteria. Failure to adhere to these requirements can result in coverage interruption, leading to significant financial and logistical challenges. This section Artikels the processes and considerations for ensuring uninterrupted coverage.

Renewal Procedures for SNAP-Eligible Drivers

Renewal of car insurance, particularly for individuals utilizing SNAP benefits, involves a similar process as for other drivers. However, understanding the specific documentation requirements and deadlines is crucial to avoid lapse in coverage. Insurance providers typically require proof of address, vehicle information, and a valid driver’s license. SNAP recipients may need to provide documentation of their SNAP benefit status.

These procedures are designed to verify eligibility and ensure accurate premiums.

Requirements for Maintaining Coverage Eligibility

Maintaining SNAP-linked car insurance coverage necessitates ongoing compliance with eligibility criteria. These requirements typically include maintaining valid identification, including driver’s license and proof of address, along with continued eligibility for SNAP benefits. Regular review of these requirements is essential to avoid potential coverage interruptions.

A shadowed path, where burdens lie, and car insurance with SNAP benefits seems a distant star. Yet, amidst the financial struggles, there’s a glimmer of hope. Nourishing your furry friend, ensuring their vitality, is crucial, especially for the active dog, and diamond extreme athlete dog food is a valuable option. Ultimately, though, the quest for affordable car insurance with SNAP benefits remains, a persistent echo in the heart’s quiet spaces.

Examples of Situations Leading to Coverage Loss

Several situations can lead to a lapse in insurance coverage, even for those utilizing SNAP benefits. Failure to renew the policy within the stipulated timeframe, changes in SNAP benefit status, or failure to provide updated documentation to the insurance provider can all result in coverage loss. A change in residence without notifying the insurance company, for example, can cause a lapse in coverage.

Other situations that might cause a lapse include significant modifications to the insured vehicle or changes in the driver’s license status.

Implications of Changing SNAP Benefit Status

Changes in SNAP benefit status, such as a temporary suspension or a complete cessation of benefits, can affect car insurance coverage. It’s crucial for SNAP recipients to notify their insurance provider promptly about any changes in their benefit status. This notification allows the provider to adjust premiums or eligibility accordingly, if necessary, preventing coverage gaps. The lack of timely communication might lead to coverage interruption and financial implications.

Table: Potential Reasons for Coverage Interruption

| Reason for Coverage Interruption | Explanation |

|---|---|

| Failure to Renew Policy | Failing to renew the policy within the specified timeframe, potentially due to oversight or lack of awareness. |

| Change in SNAP Benefit Status | A temporary or permanent cessation of SNAP benefits might trigger coverage adjustments or interruption. |

| Failure to Provide Updated Documentation | Failure to provide updated information, such as address or driver’s license changes, to the insurance provider. |

| Vehicle Modifications | Significant modifications to the insured vehicle, potentially altering the risk assessment and impacting coverage eligibility. |

| Change in Driver Status | Changes in the driver’s license status (e.g., suspension, revocation) may lead to coverage interruption. |

Addressing Potential Challenges

Accessing affordable car insurance while utilizing SNAP benefits presents unique challenges. These difficulties often stem from the intricate interplay between eligibility criteria, insurance provider policies, and the complexities of the SNAP benefit system itself. Understanding these potential issues is crucial for navigating the process effectively and ensuring successful coverage.Navigating the complexities of financial assistance programs and insurance requirements can be daunting.

A proactive approach, involving careful research, clear communication, and a thorough understanding of available resources, is essential to overcome these hurdles and secure suitable coverage.

Potential Issues in Eligibility

The eligibility criteria for SNAP benefits and car insurance policies often intersect. For instance, certain income thresholds or asset limits might affect eligibility for both programs. A comprehensive understanding of these requirements is paramount to avoid complications during the application process.

Variations in Insurance Provider Policies

Insurance providers may have differing policies regarding coverage for individuals using SNAP benefits. Some providers might have specific requirements or limitations that are not readily apparent. It is crucial to inquire about these policies directly with the insurance provider. A clear understanding of the provider’s requirements ensures a smooth application and avoids potential denials or exclusions.

Documentation Requirements and Verification Processes

Insurance companies often require specific documentation to verify eligibility for SNAP benefits. The nature and extent of this documentation can vary significantly. This process can be time-consuming and require multiple interactions with both the insurance company and the SNAP benefit provider. Understanding these procedures in advance is key to efficient and successful application.

Dispute Resolution and Appeals

Occasionally, individuals might experience issues with their car insurance application or coverage due to SNAP benefit-related factors. A clear understanding of the insurance company’s dispute resolution and appeals process is crucial. If a dispute arises, prompt action and adherence to the established procedures are essential to resolve the issue efficiently.

Common Problems and Solutions

- Inaccurate Information Provided: Mistakes in providing information about SNAP benefits or personal details can lead to application rejection or incorrect coverage. Carefully reviewing and double-checking all submitted information is critical. Contacting the insurance provider for clarification or assistance is a vital step to rectify any errors.

- Difficulty in Providing Documentation: Obtaining and providing the necessary documentation for SNAP benefits verification can sometimes be challenging. Seeking support from SNAP benefit agencies or local assistance programs can aid in the process. Knowing the required documents and procedures in advance helps in preparing and organizing the needed paperwork.

- Coverage Limitations or Exclusions: Insurance providers might have limitations or exclusions regarding coverage for individuals utilizing SNAP benefits. Inquiring about specific coverage details and limitations is essential to avoid misunderstandings and secure appropriate coverage. This can involve requesting detailed policy information from the insurance company.

Seeking Assistance and Clarification

Insurance providers usually have dedicated customer service channels for addressing inquiries and resolving issues. Contacting these channels for clarification on eligibility criteria, policy details, or dispute resolution procedures is a vital step. Utilizing these resources effectively can streamline the process and help overcome potential hurdles.

Resources for Support and Guidance

- Insurance Consumer Protection Agencies: These agencies provide information and guidance on insurance-related matters. Utilizing these agencies’ resources can offer valuable insights and assistance in navigating the complexities of car insurance.

- SNAP Benefit Agencies: Local SNAP benefit agencies can provide guidance on the application process and documentation requirements. Contacting these agencies is crucial for ensuring accurate information about SNAP benefits.

- Legal Aid Organizations: Legal aid organizations may offer assistance to individuals facing challenges in securing car insurance with SNAP benefits. These organizations can offer guidance on resolving disputes or navigating complex legal procedures.

Illustrative Examples

Illustrative examples of how SNAP benefits intersect with car insurance premiums provide valuable insights into the financial implications for eligible individuals. These examples demonstrate the potential for both cost reductions and, in certain cases, increased financial responsibility. Understanding these nuances is crucial for effective budgeting and insurance planning.SNAP benefits, while not directly impacting insurance rates, can influence the affordability of premiums and coverage options.

The effect depends on factors such as the applicant’s credit history, driving record, and the specific insurance market. These examples highlight the complexities involved and provide concrete illustrations.

Impact on Premiums

SNAP benefits themselves do not directly affect insurance premiums. However, they can influence the applicant’s ability to meet the financial obligations associated with premiums and coverage. The presence of SNAP benefits may not lower the insurance premium itself, but it might impact the ability to secure affordable coverage.

Impact on Coverage Levels

Different coverage levels, such as liability, comprehensive, and collision, can be influenced by various factors. While SNAP benefits may not directly impact coverage limits, the availability and affordability of specific coverage levels can be affected by the applicant’s overall financial situation. This is a critical consideration when choosing coverage options.

Impact on Need for Additional Financial Protection

The potential need for additional financial protection, such as gap insurance or uninsured/underinsured motorist coverage, can be influenced by the financial constraints presented by the need to maintain coverage. If SNAP benefits are insufficient to cover the full cost of insurance, additional financial resources may be necessary. Budgeting and exploring different insurance options become paramount.

Impact on Out-of-Pocket Costs

SNAP benefits can potentially reduce out-of-pocket costs for car insurance. For instance, if SNAP benefits are sufficient to cover a portion of the premium, the individual’s out-of-pocket expenses are reduced. Conversely, if benefits do not fully cover the premium, the individual may need to find additional funding sources to ensure continuous coverage. These scenarios illustrate the dynamic relationship between SNAP benefits and out-of-pocket costs.

Illustrative Policy Example with SNAP Benefits

Policy Example: Jane Doe – SNAP BenefitsApplicant: Jane Doe, SNAP recipient. Vehicle: 2015 Sedan, standard coverage. Coverage Options: Liability (minimum state requirements), Comprehensive, Collision. SNAP Benefits: $500 per month. Insurance Premium: $125 per month.

Monthly Out-of-Pocket Expenses: $75 per month (difference between SNAP benefit and insurance premium). Policy Terms: Standard policy terms, including policy period and claims procedures. Important Considerations: Jane must ensure sufficient funds to meet monthly out-of-pocket expenses.

Conclusion

In conclusion, navigating car insurance with SNAP benefits requires a meticulous approach. This guide has illuminated the critical steps, from understanding eligibility to securing affordable coverage. By comprehending the nuances of SNAP benefit integration, individuals can confidently secure the protection their vehicles deserve, ensuring peace of mind and mobility. Remember to seek professional guidance for personalized support.

Frequently Asked Questions: Car Insurance With Snap Benefits

Does SNAP affect my car insurance premium?

SNAP benefits can influence your car insurance premium. Premiums might be adjusted based on the availability of these benefits and their impact on your overall financial profile.

What types of car insurance coverage are available?

Standard car insurance coverages like liability, collision, and comprehensive are available. The specifics of coverage with SNAP benefits might vary depending on the provider.

How do I find insurance providers that accept SNAP benefits?

Research online for insurance providers that explicitly state their acceptance of SNAP benefits. Comparison websites can be helpful for finding suitable options.

What documents are required for applying with SNAP benefits?

Specific documentation might be needed, including SNAP benefit identification cards and proof of residency. Contact the insurance provider for the exact requirements.