Type 2 diabetes life insurance can be a complex topic, but understanding your options is crucial. This guide provides a comprehensive overview of how type 2 diabetes affects your life insurance eligibility, exploring factors like premiums, coverage limitations, and the strategies you can employ to secure suitable coverage. We’ll delve into the details of insurance companies’ evaluation processes, highlighting the importance of managing your diabetes effectively and honestly disclosing your condition.

Navigating the world of insurance with type 2 diabetes can feel daunting, but armed with knowledge and the right strategies, you can find the best possible coverage. This guide will empower you with the information you need to make informed decisions and secure the life insurance you deserve.

Understanding Type 2 Diabetes

Type 2 diabetes is a seriously common condition, affecting millions in the US. It’s basically when your body struggles to use insulin effectively, leading to high blood sugar levels. Think of it like a party your body can’t manage. Insulin is like the host, inviting glucose (sugar) from the food you eat to enter your cells for energy.

In Type 2 diabetes, the host isn’t doing its job properly, leaving glucose floating around and causing problems.

Causes of Type 2 Diabetes

Type 2 diabetes often develops gradually, often over time. Lifestyle factors play a major role. Being overweight or obese, not getting enough exercise, and having a family history of diabetes all increase your risk. Poor diet choices, high in processed foods and sugars, contribute significantly. Age is also a factor; the risk increases as you get older.

Interestingly, certain ethnic groups have a higher likelihood of developing the condition. Genetics and some medical conditions can also contribute.

Symptoms of Type 2 Diabetes

The symptoms of Type 2 diabetes can be subtle, sometimes even undetectable for years. Common symptoms include frequent urination, especially at night, increased thirst, unexplained weight loss, and persistent fatigue. Blurred vision and slow-healing sores are also possible signs. If you’re experiencing these symptoms, it’s crucial to talk to a doctor.

Long-Term Health Implications, Type 2 diabetes life insurance

Type 2 diabetes can significantly impact your overall health, leading to a host of serious complications. These include heart disease, stroke, nerve damage (neuropathy), kidney disease, eye problems (retinopathy), and foot problems. Controlling blood sugar levels is essential to mitigating these risks. Think of it like keeping a well-maintained car – consistent care is key to preventing major breakdowns.

Management Strategies

Managing Type 2 diabetes is a journey, not a destination. It’s about making sustainable lifestyle changes to control blood sugar levels. Diet plays a crucial role; a balanced diet with plenty of fruits, vegetables, and whole grains is key. Regular exercise is another essential component, promoting healthy blood sugar levels. Medication, including oral medications and insulin, may also be necessary to manage blood sugar.

Treatment Options

Treatment options for Type 2 diabetes vary based on individual needs and the severity of the condition. Lifestyle modifications are often the first line of defense, focusing on diet and exercise. Oral medications, such as metformin, can help regulate blood sugar levels. In some cases, insulin therapy may be necessary. The most effective approach often involves a combination of these strategies.

It’s like assembling a toolbox with different tools to tackle the problem.

Comparison Table: Type 2 Diabetes vs. Other Diabetes Types

| Characteristic | Type 1 Diabetes | Type 2 Diabetes | Gestational Diabetes |

|---|---|---|---|

| Cause | Autoimmune response destroying insulin-producing cells. | Insulin resistance and/or insufficient insulin production. | Hormonal changes during pregnancy. |

| Symptoms | Often sudden onset, including extreme thirst, frequent urination, and rapid weight loss. | Gradual onset, often with few or subtle symptoms, sometimes none. | High blood sugar levels, often with no initial symptoms. |

| Treatment | Insulin therapy is always necessary. | Lifestyle changes, oral medications, and/or insulin therapy. | Dietary modifications, exercise, and blood sugar monitoring. Insulin therapy may be required. |

Impact on Life Insurance

Yo, so you’ve got Type 2 diabetes? That’s a serious thing, and it definitely affects your life insurance game. It’s not a death sentence for your coverage, but you gotta know the rules of the game to play it right. Insurance companies look at your health status, and a chronic condition like diabetes is a factor they consider.

Let’s dive into the details.Insurance companies aren’t just handing out policies willy-nilly. They’re businesses, and they need to make sure they’re not taking on too much risk. Diabetes can increase the likelihood of certain health complications, and that risk is factored into the cost and terms of your policy. This means your premiums might be higher, and your coverage might be limited in some ways.

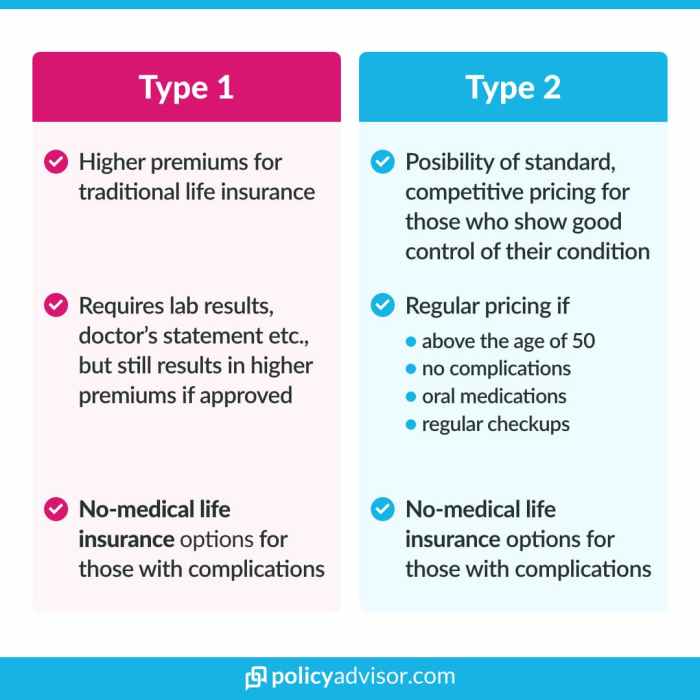

How Diabetes Affects Eligibility

Insurance companies use a risk assessment to determine your premium and coverage. They analyze your medical history, including diagnoses and treatment plans. Diabetes is a pre-existing condition, meaning it’s something that happened before you applied for insurance. Companies consider the duration and severity of the condition, as well as your overall health. For example, if you’ve managed your diabetes well and have stable blood sugar levels, your risk profile might be lower than someone with uncontrolled diabetes and a history of complications.

Potential Premiums and Coverage Limitations

Your premiums will likely be higher with diabetes. This is because insurance companies have to account for the increased costs of healthcare associated with managing the condition. Coverage limitations can also occur. For example, certain policies may have exclusions for pre-existing conditions, which might mean you have limited coverage for related illnesses or procedures. Some companies might offer lower coverage amounts for certain types of policies or only provide coverage after a waiting period, as a way to manage their risk.

Also, the terms and conditions of your policy might change if you experience any complications.

Securing type 2 diabetes life insurance can be a delicate dance, requiring careful consideration of various factors. Fortunately, protecting your valuable assets, like your home, is equally important. Consider Travelers’ comprehensive high value home insurance options for peace of mind; travelers high value home insurance can provide a robust safety net, allowing you to focus on the more pressing concerns of your health and the potential challenges of managing type 2 diabetes insurance.

Ultimately, securing the best possible coverage for your health and assets remains paramount.

Examples of Affected Policies

Different insurance policies can be impacted differently. For instance, a term life insurance policy, designed for a specific period, might have higher premiums and have coverage limits if you have diabetes. On the other hand, whole life insurance, which provides lifelong coverage, might also have higher premiums, and might have exclusions on certain conditions. The specifics really depend on the individual policy and the insurance company.

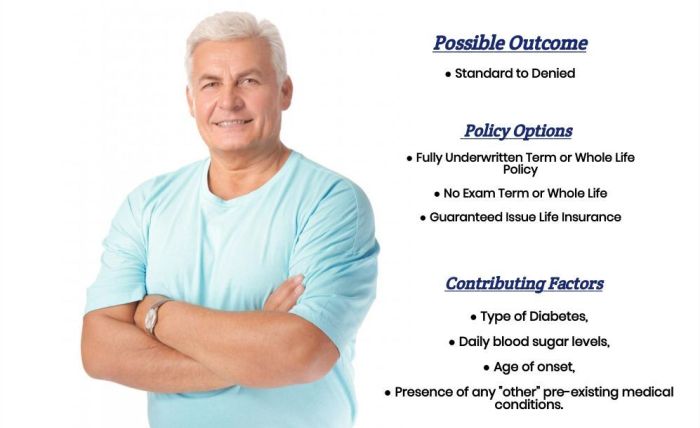

Factors Considered by Insurance Companies

Insurance companies evaluate applicants with Type 2 diabetes by looking at a bunch of factors. They’ll consider your blood sugar control (A1C levels), the duration of your diagnosis, your treatment history, and any complications you’ve experienced, like nerve damage or kidney problems. They’ll also look at your overall health, lifestyle choices (diet, exercise), and any other pre-existing conditions.

This comprehensive assessment helps them determine the appropriate risk level and tailor the policy accordingly.

Insurance Policy Responses to Applicants with Type 2 Diabetes

| Policy Type | Typical Response |

|---|---|

| Term Life Insurance | Higher premiums, potential coverage limitations, or exclusions for pre-existing conditions. Waiting periods might apply. |

| Whole Life Insurance | Higher premiums, potential coverage limitations, or exclusions for pre-existing conditions. Waiting periods might apply. |

| Disability Insurance | Higher premiums, potential coverage limitations, or exclusions for pre-existing conditions. Waiting periods might apply. |

| Critical Illness Insurance | Higher premiums, potential coverage limitations, or exclusions for pre-existing conditions. Waiting periods might apply. |

Factors Affecting Insurance Decisions

Yo, folks, navigating the wild world of life insurance with type 2 diabetes can feel like trying to hit a moving target. But don’t sweat it! Understanding the factors that play into your insurance decisions can help you get a handle on things. It’s all about showing the insurance companies that you’re on top of your game when it comes to managing your diabetes.Insurance companies aren’t just looking at your diagnosis; they’re scrutinizing your entire health picture, especially when it comes to chronic conditions like diabetes.

They want to know how well you’re managing it, and that’s where the rubber meets the road. Think of it like this: a consistent, proactive approach to diabetes management speaks volumes about your long-term health prospects.

Diabetes Management’s Impact on Insurance

Managing your diabetes effectively directly influences your insurance premiums. A history of consistently well-controlled blood sugar levels and proactive healthcare demonstrate your commitment to your health. This translates to lower risk for the insurance company, leading to potentially lower premiums. Conversely, inconsistent management signals higher risk, which often means higher premiums. It’s all about showing you’re a responsible, proactive individual.

A1C Levels and Blood Glucose Control

Your A1C level is a crucial indicator of your average blood sugar control over the past few months. Lower A1C levels typically reflect better blood glucose control, which, in turn, positively impacts your insurance outlook. Insurance companies often look at recent A1C test results to gauge your long-term risk. Think of it like this: a consistent pattern of low A1C levels tells the insurance company you’re committed to staying healthy.

A consistent pattern of high A1C levels may lead to a higher premium.

Importance of Regular Medical Check-ups and Doctor’s Reports

Regular check-ups and detailed doctor’s reports are your ammo in the battle for favorable insurance rates. They provide concrete evidence of your commitment to your health and how well you’re managing your diabetes. Think of these reports as your health resume – consistent, detailed, and impressive! Insurance companies need these reports to understand your overall health picture and how well your condition is being managed.

Your doctor’s reports show them the work you’re putting in, and the consistency in that work is key.

Examples of Consistent Health Management

Let’s say Sarah consistently maintains an A1C level below 7, has regular doctor’s appointments, and actively participates in managing her blood sugar. This proactive approach significantly reduces her risk profile and likely translates into lower premiums. Conversely, imagine John, who hasn’t had consistent A1C checks and has a history of high blood sugar readings. This inconsistency would increase his risk profile, potentially resulting in higher premiums.

These examples demonstrate how proactive health management directly influences insurance outcomes. You’re not just managing your diabetes; you’re managing your insurance!

Factors Affecting Insurance Premiums

| Factor | Impact on Premium |

|---|---|

| Consistent A1C levels below 7 | Lower premium |

| Regular medical check-ups and doctor’s reports | Lower premium |

| History of well-managed blood glucose | Lower premium |

| Evidence of active participation in diabetes management | Lower premium |

| Recent hospitalizations related to diabetes | Higher premium |

| Poorly controlled blood sugar (high A1C) | Higher premium |

| Lack of consistent medical records | Higher premium |

Insurance Options and Strategies: Type 2 Diabetes Life Insurance

So, you’ve got type 2 diabetes, and now you’re navigating the wild world of life insurance? Don’t sweat it, fam! It’s totally manageable, and we’re here to break down your options. This ain’t rocket science, just some smart strategies to keep your coverage lookin’ fly.

Insurance Options for Type 2 Diabetes

Finding the right policy can feel like searching for a needle in a haystack. But different policies cater to different needs. Understanding the options available is key.

| Insurance Type | Description | Suitability for Type 2 Diabetes |

|---|---|---|

| Term Life Insurance | Provides coverage for a specific period (e.g., 10, 20, or 30 years). Often less expensive than permanent policies. | Generally suitable, but premiums might be higher depending on the specifics of your health. |

| Permanent Life Insurance (e.g., Whole Life, Universal Life) | Provides lifelong coverage, often with a cash value component that can grow over time. | Premiums could be significantly higher than term, but you’re covered for life. |

| Guaranteed Issue Life Insurance | Offers coverage regardless of health status, though with limitations on coverage amounts and premiums. | Excellent option for those with Type 2 diabetes who might struggle to qualify for standard policies. |

Strategies for Securing Coverage

Finding insurance with Type 2 diabetes doesn’t mean giving up on your dreams. There are strategies that can make a huge difference.

- Shop Around: Compare quotes from multiple insurers. Different companies have different criteria and pricing structures. Just like comparing prices on sneakers, you want to find the best deal for you.

- Consider a Term Policy First: A shorter-term policy can be a great way to get coverage without the higher premiums associated with permanent policies. It’s like a stepping stone to a bigger and better policy later.

- Healthy Lifestyle Choices: Maintaining a healthy lifestyle can impact your eligibility. A healthier you means a better chance of getting the coverage you need. Think about the impact of diet, exercise, and management strategies on your overall health. This is super important.

Pre-Existing Condition Waivers

Pre-existing condition waivers can be game-changers. They allow insurers to waive certain requirements related to your condition, giving you a fighting chance at coverage. These waivers are like a loophole in the rules, allowing you to get the insurance you need.

Pre-existing condition waivers are not always guaranteed, and eligibility varies by insurer.

Improving Eligibility with Type 2 Diabetes

There are ways to increase your chances of getting approved for insurance.

- Maintain Good Control: Excellent blood sugar control and management significantly improve your chances of getting approved. Show the insurance company that you’re proactive in managing your condition.

- Documentation: Keep detailed records of your health. This includes medical reports, test results, and doctor’s notes. This documentation is your proof of good health management.

- Open Communication: Be upfront and honest with insurance providers. They need this information to assess your risk. Transparency is key. This is a super important aspect.

Honest Disclosure and Open Communication

Being honest with insurance providers is critical. They need accurate information to assess your risk. Hiding information can backfire in the long run.

Honesty and open communication are essential for navigating the insurance process.

Claims and Benefits

So, you’ve got your Type 2 diabetes under control, and you’re looking to lock down some sweet life insurance. Knowing how claims work is crucial for peace of mind. This section breaks down the potential hoops you might jump through and how to navigate them.Claims processes and benefits for people with Type 2 diabetes are generally similar to those for people without the condition, but there are important nuances to understand.

Insurance companies often consider pre-existing conditions, and the specifics of your coverage will heavily influence the outcome.

Potential Claim Issues

Insurance companies evaluate claims based on the policy specifics, and often include pre-existing conditions in their underwriting criteria. A claim for a death related to Type 2 diabetes could face scrutiny, especially if the insured’s condition was not properly disclosed or managed during the policy period. Furthermore, if the insured’s death was caused by a complication directly linked to poorly managed diabetes, such as a heart attack or stroke, the insurance company might investigate.

Conditions Affecting Claims

Several factors can influence a claim’s outcome. For example, a history of severe or uncontrolled diabetes, resulting in complications like kidney failure or blindness, could lead to a denied claim or a reduced payout. Similarly, if the insured failed to adhere to prescribed treatments, it could impact the claim’s evaluation. Also, if the cause of death is directly attributable to complications arising from poorly controlled Type 2 diabetes, it could be viewed as a factor in the claim’s assessment.

Examples of Claim Impact

Imagine someone with Type 2 diabetes, whose policy stipulated that pre-existing conditions were covered but with limitations. If they died from a heart attack directly linked to uncontrolled diabetes, the payout might be significantly lower than anticipated, or even denied. Another scenario involves someone with a history of diabetic neuropathy, whose claim for accidental death is affected if the cause of death is linked to the condition, such as a fall.

Procedures for Appealing Denied Claims

If your claim is denied, don’t panic! Most insurance companies have an appeals process. Carefully review the denial letter for specific reasons and gather supporting documentation, like medical records and treatment logs. Contact the insurance company’s claims department immediately to initiate the appeal process. Be prepared to provide evidence demonstrating how the denial is inaccurate or unjust.

Summary of Claims Scenarios

| Claim Scenario | Potential Outcome |

|---|---|

| Death due to complications directly linked to well-managed Type 2 diabetes, and all policy conditions met. | Claim likely approved with full benefit payout. |

| Death due to complications directly linked to poorly managed Type 2 diabetes, and all policy conditions met. | Claim may be denied or have reduced payout, depending on policy specifics. |

| Death due to unrelated cause, but pre-existing Type 2 diabetes not fully disclosed. | Claim may be denied or have reduced payout, depending on policy specifics. |

| Death due to complications directly linked to well-managed Type 2 diabetes, but policy excludes certain pre-existing conditions. | Claim may be denied or have reduced payout, depending on policy specifics. |

Illustrative Case Studies

Navigating the world of life insurance with type 2 diabetes can feel like navigating a pop-culture themed obstacle course. But fear not, fam! We’re breaking down real-life scenarios to show you how different levels of diabetes management directly impact your insurance options. Think of it as a behind-the-scenes look at how the insurance game works.Understanding how insurance companies assess risk is key to making informed decisions.

This involves a comprehensive evaluation of your health status, including your diabetes management. Insurance companies use data-driven approaches to determine premiums and eligibility, so understanding the factors involved is crucial for securing the best possible coverage.

Securing type 2 diabetes life insurance can sometimes feel like navigating a complex culinary landscape. One might ponder, much like the careful selection of stabilisers in food, what are stabilisers in food , precisely how certain lifestyle choices, including diet and exercise, can influence the premiums. Ultimately, understanding these factors is crucial for securing the most favourable policy terms for those with type 2 diabetes.

Impact of A1C Levels on Insurance Premiums

Insurance companies use A1C levels to gauge long-term blood sugar control. Higher A1C levels generally translate to higher premiums, reflecting a greater perceived risk. A consistent A1C below 7% often leads to more favorable rates.

Imagine two applicants, both with type 2 diabetes. Applicant A maintains a consistently low A1C level, typically around 6.5%. Applicant B, however, experiences more fluctuating blood sugar levels, resulting in an A1C closer to 8%. The insurance company will likely assess Applicant A as a lower risk, leading to potentially lower premiums.

An Individual’s Journey Through the Insurance Process

This detailed example follows a fictional individual, “Sarah,” through her life insurance application process. Sarah was diagnosed with type 2 diabetes a few years ago. She actively manages her condition through a healthy diet, regular exercise, and medication.

- Application Submission: Sarah completes her application, accurately disclosing her diabetes diagnosis and providing detailed medical records, including A1C results and other relevant health information. She highlights her consistent management strategies.

- Underwriting Process: The insurance company reviews Sarah’s application and medical records, taking into account her A1C levels, medication adherence, and lifestyle choices. They scrutinize the consistency of her blood glucose control. The company might request additional information or even schedule a consultation with her physician.

- Premium Assessment: Based on her A1C levels, medical history, and ongoing management, the insurance company determines a premium. Since Sarah’s A1C levels are consistently in the healthy range, the company might offer a competitive premium rate.

- Policy Issuance: If Sarah’s application is approved, the company issues her a life insurance policy with the agreed-upon coverage and premium.

Steps When Dealing with Insurance Issues Due to Diabetes

Navigating insurance issues can be tricky, especially with a condition like type 2 diabetes. Here are crucial steps to take:

- Accurate Disclosure: Always be truthful and transparent about your health condition when applying for insurance. Honesty is your best friend here.

- Comprehensive Documentation: Gather all relevant medical records, including A1C test results, doctor’s notes, and treatment plans. This provides crucial evidence of your condition management.

- Proactive Communication: If you experience issues or concerns during the insurance process, communicate promptly and professionally with the insurance company. Seek clarification or dispute points of contention.

- Professional Consultation: Consider consulting with a financial advisor or insurance professional for guidance and support during the process. This will allow you to ask important questions.

Improving Insurance Eligibility Through Lifestyle Changes

A remarkable example illustrates the impact of positive lifestyle changes on insurance eligibility. Imagine a person, “David,” who was initially denied coverage due to high A1C levels. He recognized the need for significant improvement.

David embarked on a comprehensive lifestyle transformation, focusing on a balanced diet, regular exercise, and meticulous blood glucose monitoring. He worked closely with his healthcare provider to adjust his medication regimen. Over time, David saw a marked improvement in his A1C levels, demonstrating a commitment to his health. He reapplied for insurance, providing updated medical records reflecting these positive changes.

This proactive approach ultimately resulted in a favorable outcome, securing insurance coverage.

Wrap-Up

In conclusion, securing life insurance with type 2 diabetes is achievable with the right approach. This guide has equipped you with the knowledge to understand the intricacies of the process, from the impact of diabetes management on insurance decisions to the importance of honest disclosure. By proactively managing your condition and seeking appropriate advice, you can significantly increase your chances of securing favorable insurance terms.

Remember, open communication and a proactive approach are key to navigating this journey successfully.

Questions and Answers

What factors influence the premiums for life insurance with type 2 diabetes?

Insurance companies consider various factors, including your A1C levels, the duration and severity of your diabetes, your treatment history, and the overall management of your condition. Consistent, proactive management demonstrably affects premium rates.

Are there specific types of life insurance policies that might be affected by type 2 diabetes?

Many types of life insurance policies can be affected, including term life insurance, whole life insurance, and even critical illness insurance. The specific impacts vary depending on the policy and the insurer.

How important is honest disclosure when applying for life insurance with type 2 diabetes?

Honest disclosure is paramount. Providing accurate information about your condition is essential for securing fair and accurate coverage. Insurance providers need this information to assess risk accurately.

What are some strategies to improve my insurance eligibility despite type 2 diabetes?

Maintaining healthy A1C levels, demonstrating consistent management through medical records, and showcasing proactive lifestyle choices are crucial strategies. Open communication with your insurance provider and seeking professional advice can also significantly increase your chances of success.